Had a buddy say that recently. Granted, he's not in the US, but the same concept applies.

As an accountant, it makes my head hurt.

Honestly, I used to think this was the case until someone on here explained it. Good to know though that I'm stupid beyond belief for not knowing it previously.

Also this is 2 min of the west wing for folks who want to watch instead of read:

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13673574/3.png)

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13673595/9.png)

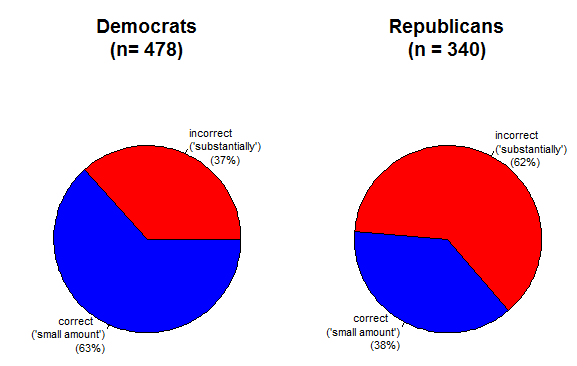

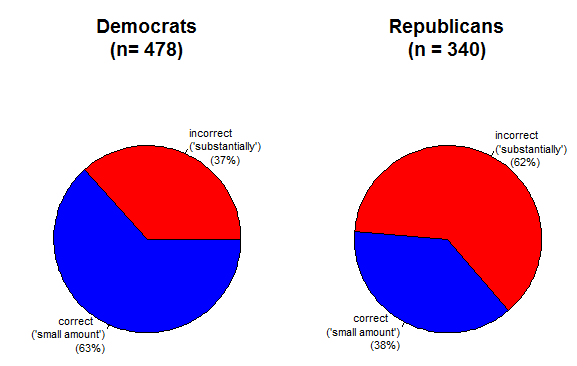

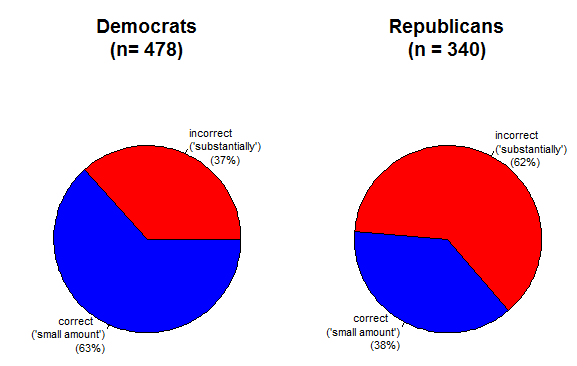

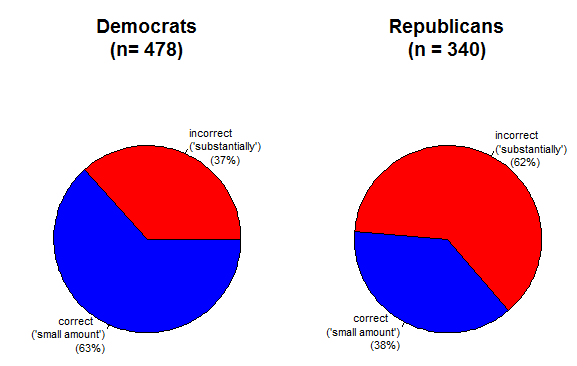

This perfectly encapsulates how bullshit it is to think republicans are the 'tough but smart' party vs dems being the party of feelings, which is basically the common wisdom because americans have some sort of toughness complex that makes them intuit that policies that help people must make us weak or something."Suppose that your income put you at the very top of the 28% tax bracket and you earned one more dollar such that you were now in the 33% tax bracket."

Below: Changes in your tax burden based of the above scenario

https://today.yougov.com/topics/pol...standing-how-marginal-taxes-work-its-all-part

This is very old. I can only imagine it has gotten worse on the republican side of things with the way the party has changed in the last 6 years

Here's a handy Vox article with pics to explain for those interested

How marginal tax rates actually work, explained with a cartoon

From the same survey, this is also pretty telling:"Suppose that your income put you at the very top of the 28% tax bracket and you earned one more dollar such that you were now in the 33% tax bracket."

Below: Changes in your tax burden based of the above scenario

https://today.yougov.com/topics/pol...standing-how-marginal-taxes-work-its-all-part

This is very old. I can only imagine it has gotten worse on the republican side of things with the way the party has changed in the last 6 years

They need to really teach basic math and paycheck/tax/money math in high school. People just don't get it. My step daughter had one elective in HS where they touched on it for 30 minutes or so... that's it.

People just don't understand money at all, it's mind boggling

Edit... oh christ at the tax stupid being split so unevenly along party lines... Lol sad

6 weeks on credit cards, compound interest, loans

6 weeks on the basics of taxes, brackets, "writing off something"

6 weeks on budgeting, saving, planning

You're not taxed $60 on $40 extra. You're having $60 more withheld. Talk to your boss about fixing that withholding, otherwise you'll get what you overpaid back (with 0% interest) as part of your tax refund.

Had a buddy say that recently. Granted, he's not in the US, but the same concept applies.

As an accountant, it makes my head hurt.

It drives me insane. I remember making this thread on Negoaf lol.I feel like I'm taking crazy pills every time someone says that they will make less money if they get a raise or thinking a top earning 70% tax rate means the government takes the whole 70% of your income.

Does this drive anyone else nuts?

I agree with the poster saying it's a lack of motivation. It's the 21st century - explanation of tax brackets is literally a click away if one wishes to learn about them. Took me a few minutes to guesstimate my approximate return by looking at the IRS websiteUntil they actually start teaching you about finances in secondary school I dunno how you can proclaim it would have no effect. What kind of logic is that? Everyone is ignorant proclaimed by you so teaching them things in school to reduce ignorance is a waste of time? The fuck?

My father was one of those people. He would say he "made less money" after his promotion.

When, in actuality, what he paid in taxes simply increased proportionately to his income. So even though he also made more money, all he looked at was the fact he paid more in his taxes, because he was an imbecile. All the actual money he made that he still had and/or spent apparently didn't count. Because I guess people expect their numbers to always be the same? I don't even know.

And I can understand being confused about this when you're like, 20, and have never made more than $25,000 a year. But he was an adult in his fifties with three houses.

https://twitter.com/aoc/status/1085245511324581889?s=21Explaining marginal taxes to a far-right former Governor:

Imagine if you did chores for abuela & she gave you $10. When you got home, you got to keep it, because it's only $10.

Then we taxed the billionaire in town because he's making tons of money underpaying the townspeople.

Well, a major problem is that none of this shit gets taught in school. Personal finance really should be part of a basic school curriculum

People keep repeating this line, but where are you cutting 2 semesters from? This can be part of the problem solving section of basic math and algebra courses, but already schools fall into one of two categories. If they have freedom they already include personal finance into math, if they are teaching towards standardized examns they only look at the multiple questions aspect. We cannot just decide to downplay trigonometry, algebra, arithmetics, etc to teach simple applications

I think this is kind of a bad question though in a very basic sense. Say someone does not understand marginal taxes and believes that their whole income will now be taxed at 33% rather than the 28% they were paying previously. Even if they believe that, someone could see a change of 5% as being a "small amount," whereas others could view the 5% change as a "substantial increase." The question should be a little more drastic in the change in bracket, say going from paying 10% in the lower bracket to 90% in the higher bracket. That or they should just ask for a numerical answer to really drive the point home and avoid the subjectivity of what people view as small and substantial increases."Suppose that your income put you at the very top of the 28% tax bracket and you earned one more dollar such that you were now in the 33% tax bracket."

Below: Changes in your tax burden based of the above scenario

https://today.yougov.com/topics/pol...standing-how-marginal-taxes-work-its-all-part

This is very old. I can only imagine it has gotten worse on the republican side of things with the way the party has changed in the last 6 years

Well, a major problem is that none of this shit gets taught in school. Personal finance really should be part of a basic school curriculum

Maybe we can? Everyone needs personal finance to a degree, it's really an important knowledge base in our society, much more so than trig to be honest.

A matter of priorities.

I mean Trigonometry is pretty essential knowledge in society. You wouldn't have a lot of things without it...

Why not teach both?