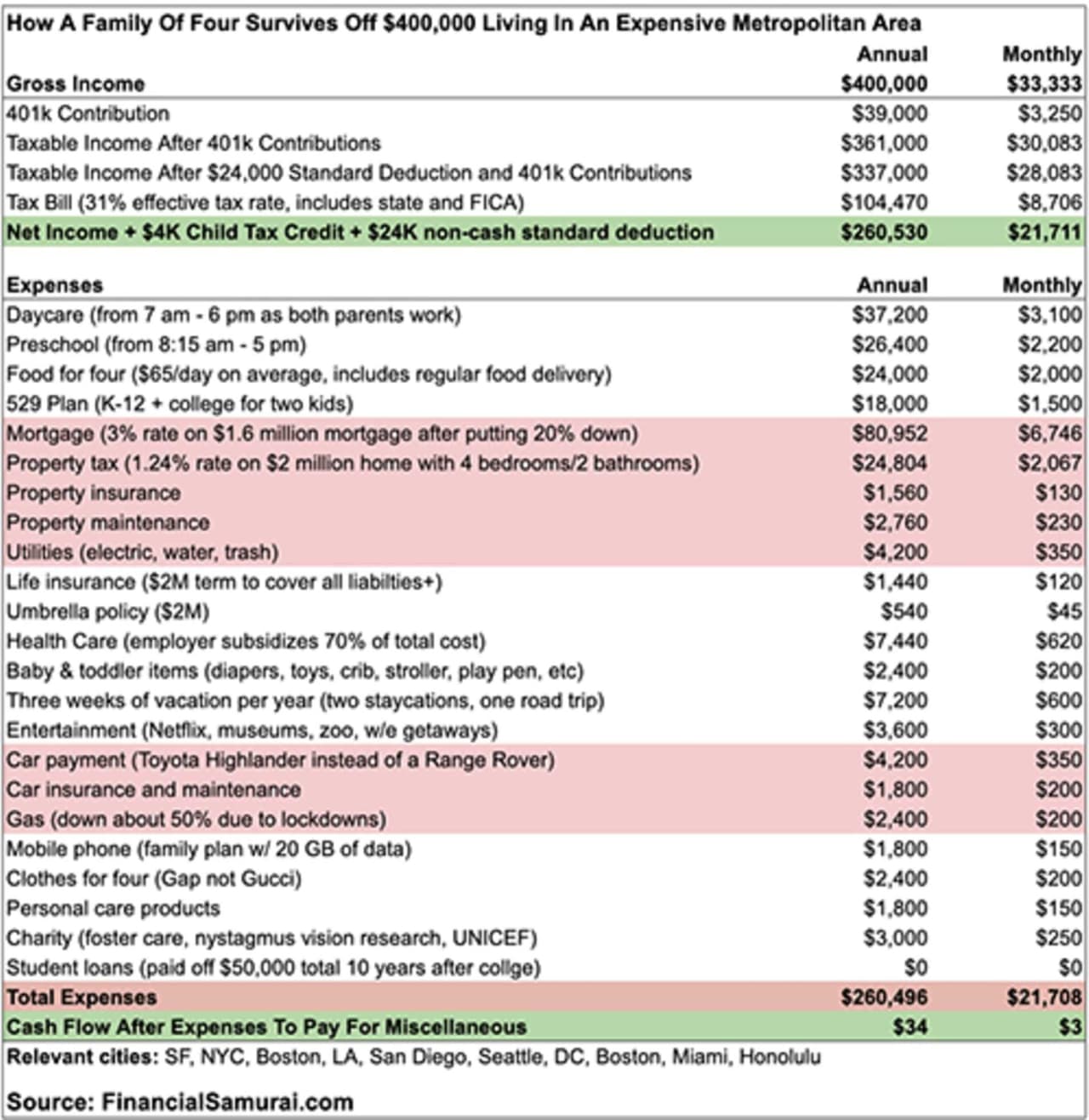

Problem: Loss of income by not living in a high property tax area.Solution: Don't buy a 2 million dollar home in a high property tax area.

Marketwatch: Why those earning 400k per year are barely scraping

- Thread starter Deleted member 21339

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

spot on

Mortgage makes sense if you're earning that kind of income. The daycare and preschool? WHAT? Why would you need both? Is one child a baby and another 4 years old? Most daycares I know are also pre-schools. And even the high end ones here in Los Angeles charge $1500/child per month. Also, we eat luxuriously in my house of 5 people. Our total food expenditure including dining out is $1500 or less.

I don't get this. Plus, this household is maxing out 401K, and likely have other assets. This is bullcrap if you ask me.

Edit:

Wait... private school? Yeah, not scrapping by. This is nonsense.

I don't get this. Plus, this household is maxing out 401K, and likely have other assets. This is bullcrap if you ask me.

Edit:

Wait... private school? Yeah, not scrapping by. This is nonsense.

So let me get this straight

A family who making half a million a year

Is broke lol.

Wait till the writer learns about a family who makes like 40k lol

Those stories always go the opposite route. The 400k family is struggling, the 40k family is wasteful spenders. 2k a month on food when your making 400k is fine. Buying yourself a coffee in the morning when you are making 40k is "wasteful spending" and you deserve to be poor you goddamn animal.

What? $3000 to Charity? Huh? What the fuck is this breakdown?

My main takeaway is that your zip code is just as important as your salary. $400k in Manhattan isn't exactly balling. That's not even upper class for a family of four. But if you sell the home and take that money elsewhere you can buy a mansion in cash and live off your investment interest. That's why so many people are leaving CA and NY.

But pairing the words struggle and $400k was bound to earn them some free clicks. They know exactly what they're doing.

I dunno, median household income in Manhattan is under $90k. Making more than 4x the median seems pretty solidly "upper class" to me.

Problem: Loss of income by not living in a high property tax area.

Solution: Rent

How exactly is paying money with no return a "solution"? That doesn't make you rich. Especially with low interest rates and high asset appreciation.

Most people that make a lot of money, spend their money to show others that they make a lot of money.

Hell, even some people who don't make THAT much will do that, living well beyond their current means. (with significant amount of credit card debt)

me and them are of two very different mentalities

If I wanted to purchase an home in the area where I live, that's the price. My household is over $200,000/year. We still rent. Edit: some people aren't just living out of their means to keep up with the Jones's. My family could move to an cheaper area. But my wife has older parents that makes it easier for us to get to if something happens.

Last edited:

They have jobs that pay that much but they're still expected to pay $7500 a year out of pocket for healthcare? That doesn't sound like a good employer healthcare provider.

That's not unreasonable for a family of four. I have a family plan through my employer, and I'm paying like $250 ish bi weekly, which is $6500/year.

And that's just premiums, it doesn't include copays or coinsurance

How exactly is paying money with no return a "solution"? That doesn't make you rich. Especially with low interest rates and high asset appreciation.

You would be saving money (no mortgage, no property taxes, other home related expenses), so not exactly 'no return'. You can invest your saved money and get a return that way.

No, you are just paying someone elses property taxes and mortgage. Versus being able to use HELOC to invest and grow your wealth as your asset appreciates. You can claim investment interest as a tax deduction offsetting your homes interest and you can also claim property taxes against federal tax (albeit limited). Unless you work from home, none of your rent is deductible.You would be saving money (no mortgage, no property taxes, other home related expenses), so not exactly 'no return'. You can invest your saved money and get a return that way.

Unless you live in a stagnant housing market, owning is almost always more profitable.

How do you spend $200 on clothes monthly, though? I can understand children outgrowing old clothes, but as an adult, you should have enough to last you several years after a point.

I have no idea. We are a family of four and we maybe spend 200 a year on clothes. We have an old navy credit card and the rewards keep our kids clothed while they continually grow out of stuff. I still wear some clothes that are a decade old.

I like how their utility bill is $350 a month. If they have a 2m house I assume it is large. No way their utility bill is nearly the same as mine. Also the car payment isn't crazy. I know plenty of people around here with new trucks that are 50k or more and they are definitely aren't making anywhere near 400k a year and i know damn well they didn't pay in full or put 20% down.

Last edited:

ewww and have their kids mingle with the plebs? fuck you.They are putting into a 529 for not just college, but "K-12" as well, which means they want to send their kids to a private school. SEND THEM TO PUBLIC SCHOOL

In a couple of years the kids will be out of daycare/preschool and you open up 50k+ Sure they will likely turn around and stick them into sports clubs and dance...but I don;t think that will eat up the entire 50k.

I like how their utility bill is $350 a month. If they have a 2m house I assume it is large. No way their utility bill is nearly the same as mine. Also the car payment isn't crazy. I know plenty of people around here with new trucks that are 50k or more and they are definitely aren't making anywhere near 400k a year and i know damn well they didn't pay in full or put 20% down.

Not necessarily. Look at this condo in NYC, 2.2 million and only 1,076 sq feet. That is 900 sq ft less than my house, which was under $200k. Having a huge mortage doesn't necessarily mean you have a 10,000 sq ft house. The most expensive house in my part of NY is 2.2 million and is 7,359 sq feet on 4,82 acres, that would have huge utility costs which the condo would not.

71 Park Ave Unit 6B, New York City, NY 10016 | realtor.com®

View 12 photos of this 2 bed, 3 bath, 1076 sqft. condo located at 71 Park Ave Unit 6B, New York City, NY 10016 on sale now for $1950000.

That mortgage does feel a bit on the high end for a home in a major metro area..I think Seattle is around 900-one million.

Problem: Loss of income by not living in a high property tax area.

Commute, motherfucker. The rest of us have to.

Yeah that is Extremely high even for 400k with a whole ass family.That mortgage does feel a bit on the high end for a home in a major metro area..I think Seattle is around 900-one million.

They're not scraping by if they're maxing out their 401k contributions and spending a good amount on food, vacation, entertainment, clothes, etc.

Scraping by would be if paying for the absolute bare necessities (rent, food, diapers, student loan, etc) left them with a marginal amount for entertainment and clothes and retirement savings.

Scraping by would be if paying for the absolute bare necessities (rent, food, diapers, student loan, etc) left them with a marginal amount for entertainment and clothes and retirement savings.

Beyond some of the magical numbers and outlandish spending that's been highlighted - if your income is covering your food, your healthcare, your investments, your kid's care and education, life insurance, vacations and getaways.... what the FUCK are you struggling for? You have everything you need and a shit ton of luxury items and expenses. What's left? Are you hoping to have 10s of thousands of cash on hand? Is it because you're settling for an SUV instead of that Lotus that you really wanted for your 45th birthday? Insanity.

^ YES, exactly.

They're not scraping by if they're maxing out their 401k contributions and spending a good amount on food, vacation, entertainment, clothes, etc.

Scraping by would be if paying for the absolute bare necessities (rent, food, diapers, student loan, etc) left them with a marginal amount for entertainment and clothes.

^ YES, exactly.

Not necessarily. Look at this condo in NYC, 2.2 million and only 1,076 sq feet. That is 900 sq ft less than my house, which was under $200k. Having a huge mortage doesn't necessarily mean you have a 10,000 sq ft house.

71 Park Ave Unit 6B, New York City, NY 10016 | realtor.com®

View 12 photos of this 2 bed, 3 bath, 1076 sqft. condo located at 71 Park Ave Unit 6B, New York City, NY 10016 on sale now for $1950000.www.realtor.com

Damn, I guess I really underestimated NYC prices. Yeah that is about 800 sq ft less than my house.

Lmao who fucking pays 6746$ a MONTH for their mortgage?!

Don't buy a fucking mansion and you'll be fine geez.

It's another version of the dril tweet

"Don't buy a house in NYC"

"No"

I worked with someone like that in Boston. Constantly complaining about money, chose to live literally in the most expensive part of the city because "I like the area." Okay then, that's a choice.

You would be saving money (no mortgage, no property taxes, other home related expenses), so not exactly 'no return'. You can invest your saved money and get a return that way.

Making people rent more is not a solution. "Be as miserable as me" isn't a solution. Houses being so expensive are a problem. I think people are getting to caught up in the rage. Of course some of this stuff is unrealistic, but ultimately the fact that someone making 400k could potentially be struggling tells you a lot about an economic system that's not sustainable.

Why do you have to live in Manhattan? Why not another borough? That said, NYC real estate is out of control. 2.2 mil for that is insane.Not necessarily. Look at this condo in NYC, 2.2 million and only 1,076 sq feet. That is 900 sq ft less than my house, which was under $200k. Having a huge mortage doesn't necessarily mean you have a 10,000 sq ft house. The most expensive house in my part of NY is 2.2 million and is 7,359 sq feet on 4,82 acres, that would have huge utility costs which the condo would not.

71 Park Ave Unit 6B, New York City, NY 10016 | realtor.com®

View 12 photos of this 2 bed, 3 bath, 1076 sqft. condo located at 71 Park Ave Unit 6B, New York City, NY 10016 on sale now for $1950000.www.realtor.com

Edit: By "you" I mean in general mostly in reference to this story and some other posts. Yes its nice to live near things and by rich people I'm sure, but whats wrong with commuting and saving tons of money?

A family of 4 with a household income of $90k qualifies for public housing in NYC:I dunno, median household income in Manhattan is under $90k. Making more than 4x the median seems pretty solidly "upper class" to me.

And I'm not the only one that thinks that upper class is a high bar in NYC, especially for a family of four:

Here’s What You Need To Be Upper Middle Class And Upper Class In NYC & It's A Lot - SportofMoney.com

Here's how much you need to be in the upper middle class and upper class in New York City. The short answer is it's a lot of money.

www.sportofmoney.com

It's just not the place to be unless you're raking it in.

I always find the clothes one funny, but I guess I can understand it for kids as they grow up. $200 a month still seems ridiculous there, though. I've probably spent $200 in the last two years on clothes, lol, and most of that was two pairs of shoes.

anyway; they could cut their childcare cost in half, food cost in half, and their vacation in half. Like they said one road trip and somehow that's costing them also 7k. Calling BS there. Those three things alone would give them almost $50,000 in liquid savings per year. Everything else seems 'ok'. I won't judge the mortgage too badly because cost of housing is pretty ridiculous in some areas. In my area, 1.6 million gets you a fantastic house, but not a gigantic mansion by any means. For their income, a 1.2 million dollar house probably would had been better, but again, without knowing where they live..

I do hate these articles, though, because they pretend a mortgage is an expense in typical terms and that a 401k is what? Nothing? They are building equity in that home and obviously a 401k is savings. Didn't even include their match I bet.

anyway; they could cut their childcare cost in half, food cost in half, and their vacation in half. Like they said one road trip and somehow that's costing them also 7k. Calling BS there. Those three things alone would give them almost $50,000 in liquid savings per year. Everything else seems 'ok'. I won't judge the mortgage too badly because cost of housing is pretty ridiculous in some areas. In my area, 1.6 million gets you a fantastic house, but not a gigantic mansion by any means. For their income, a 1.2 million dollar house probably would had been better, but again, without knowing where they live..

I do hate these articles, though, because they pretend a mortgage is an expense in typical terms and that a 401k is what? Nothing? They are building equity in that home and obviously a 401k is savings. Didn't even include their match I bet.

Last edited:

I'll use roundish numbers, but my family income is about six figures off this amount. We also live in an expensive real estate market, and a high tax state. I'm close enough to these folks that I can picture some of these expenses as my own.

Last year we bought a house that cost literally less than 1/3rd of the house in the example, and I had to be dragged kicking and screaming to the closing. Would have easily went for an even cheaper home, but my better half ultimately made a convincing case based on immediate renovation needs (or lack thereof,) better schools, QoL stuff, etc. Point being, these folks made a decision to buy a house that is immensely expensive and it is eating up the lion's share of their income. That's a choice that plenty of people make, but you don't get to complain about it after the fact, especially if life still involves vacations and a maxed out 401k and shopping at the Whole Foods instead of clipping coupons.

Last year we bought a house that cost literally less than 1/3rd of the house in the example, and I had to be dragged kicking and screaming to the closing. Would have easily went for an even cheaper home, but my better half ultimately made a convincing case based on immediate renovation needs (or lack thereof,) better schools, QoL stuff, etc. Point being, these folks made a decision to buy a house that is immensely expensive and it is eating up the lion's share of their income. That's a choice that plenty of people make, but you don't get to complain about it after the fact, especially if life still involves vacations and a maxed out 401k and shopping at the Whole Foods instead of clipping coupons.

Making people rent more is not a solution. "Be as miserable as me" isn't a solution. Houses being so expensive are a problem. I think people are getting to caught up in the rage. Of course some of this stuff is unrealistic, but ultimately the fact that someone making 400k could potentially be struggling tells you a lot about an economic system that's not sustainable.

Of course house prices are a problem in many states, not disagreeing with that. No need to rent-shame though.

Same. I actually need new clothes, but I hate clothing waste.I always find the clothes one funny, but I guess I can understand it for kids as they grow up. $200 a month still seems ridiculous there, though. I've probably spent $200 in the last two years on clothes, lol, and most of that was two pairs of shoes.

This. Plus wage stagnation. How can the price of housing keep going up and wages stay the same? Actual garbage.Of course house prices are a problem in many states, not disagreeing with that. No need to rent-shame though.

They are putting into a 529 for not just college, but "K-12" as well, which means they want to send their kids to a private school. SEND THEM TO PUBLIC SCHOOL

They spend $150 a month on phones for two adults only (they have a family plan but their two children are in preschool/day care, why do they need phones?) GET A CHEAPER PLAN

Final thing: they now apparently have "no money" for other expenditures...if you've already budgeted your 401K, 529, vacations, charity, and "entertainment"...guess what? YOU DON'T HAVE TO SPEND MONEY ELSEWHERE SO WHO CARES?

This is literally the thing that gets me... you've budgeted out non essential spending as if it's essential. Those are the things that minimum wage workers save money for. And these people are acting like because thye have the luxury to do it, they are broke.

Also... how are you spending 7k dollars on 2 staycations and a roadtrip? If Im on a staycation, it's the cheapest fucking time off i take... and if im on a road trip, im not staying at a fancy hotel that costs 1k a night... like what is this shit?