[/QUOTE]

I too have appreciated the back and forth in this thread and was confused by this.

However, Kirblar went out of his way to look for a BIS paper to refute the claim that his position about inflation dynamics was heterodox. Given the confusion, I expected an honest—and not a snide—response to the inevitable question:

...do you mean orthodox?

i was never talking about the paper because i was never talking about the relationship between demographic trends and inflation.

my comment about undergrad heterodox econ would also cross apply to orthodox economic theory in so far as some (post-keynesian) fields considered heterodox economics have a limited definition of how the transactions of modern finance capital functionally create economic value. I understand the confusion though, i cleared it up in an above post

the operative part of the label was "undergrad" because it was in reference to the simplicity of the explanation of how money functions, ignoring how the development of a mature global finance economy has challenged the rather limited explanation kirb gave. there was probably a better way to make that point

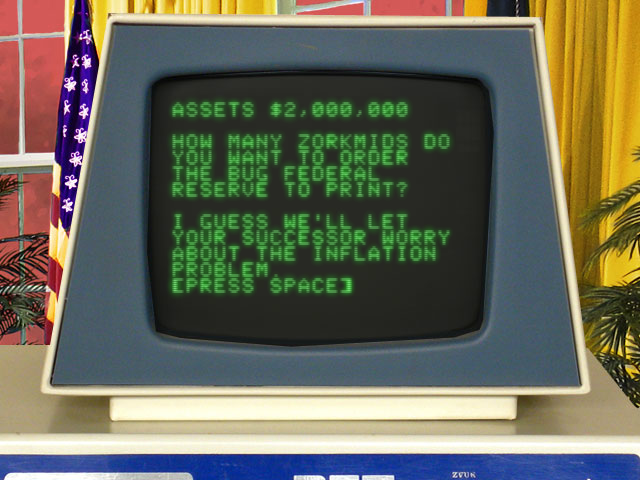

my only real point, which we are now very far from, is that the fed's liquidity bumps are differentiated from other forms of state intervention

only in so far as people in power continue to not acknowledge that these definitions are politically (and thus socially) constructed and are not technocratic realities that we have to operate under

there is a very reasonable case to be made that the united states is not anywhere near the ceiling on the extent to which it can create real value through debt. This is (allegedly) because its expansion is already one of the core operating dynamics on which value creation the current global political economy is predicated (i.e. acting as a first mover in increasing the circulation of captial between the us, china, japan, and the euromarkets)