-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

Why do people in the US put up with how little they get for their taxes?

- Thread starter Ctalkeb

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Doesn't the US have significantly lower taxes than Norway? What would you be paying in tax in Norway vs in the US? I'm curious. On topic, people complain a lot. It's literally one of the mains reasons people are even resistant to being taxed more

yea i once did this exercise with a coworker, who later became a friend from Australia. He was visiting to help while someone else was out. We paid more or less the same amount of taxes, but they get healthcare. And he was like and we pay just a little extra to get the better private healthcare stuff.

Decades of US-centric Propaganda spoon fed to us from birth to think of ourselves as the best, most perfect nation and that any form of taxes is inherently evil. Like one of the first things I learned in history class was the Boston Tea Party and that shit was pounded into my brain as the primary reason why we went to war. This propaganda is why we distrust our government with any amount of money but believe so desperately that corporations will save us and are inherently good no matter how much of our soul they rip out of us.

American exceptionalism.

www.facebook.com

www.facebook.com

I like this post a lot, although it's not perfect--she misses some major things. A good part is American's rural roots and rural preferences (Senate/EC).

Rural communities don't need as much services and they even reject when it is for their own good. Another article on this:

www.nytimes.com

www.nytimes.com

Shannon Welch

Buckle up, this one is a bit of a roller coaster. If you like my long posts, I’d recommend hitting the 3 dots in the upper right corner and hitting “save post” if you don't have a few minutes...

www.facebook.com

www.facebook.com

I like this post a lot, although it's not perfect--she misses some major things. A good part is American's rural roots and rural preferences (Senate/EC).

Rural communities don't need as much services and they even reject when it is for their own good. Another article on this:

Opinion | In the Land of Self-Defeat (Published 2019)

What a fight over the local library in my hometown in rural Arkansas taught me about my neighbors’ go-it-alone mythology — and Donald Trump’s unbeatable appeal.

Last edited:

The fact that this thread to such a immediate turn to tax revenue rather than effective government spending is indicative.

The primary failure of our two party system is that the conversation entirely surrounds how much we spend on items, press releases about how many billions we are sending due to the efforts of politicians. But by every western metric the USA is a dumpster fire at effectively spending money.

Even in the bluest of blue states our social services suck, our health care sucks, our public transit sucks, our public schools suck, our police suck. Because no one argues or fights for an effective government with accountable employees and programs, just how much we are going to spend.

The federal government already directly spends enough money on health care to provide universal health care, but no one wants to fight for reasonable costs.

The primary failure of our two party system is that the conversation entirely surrounds how much we spend on items, press releases about how many billions we are sending due to the efforts of politicians. But by every western metric the USA is a dumpster fire at effectively spending money.

Even in the bluest of blue states our social services suck, our health care sucks, our public transit sucks, our public schools suck, our police suck. Because no one argues or fights for an effective government with accountable employees and programs, just how much we are going to spend.

The federal government already directly spends enough money on health care to provide universal health care, but no one wants to fight for reasonable costs.

Taxes can only be used for two things - our big ass military, or socialism.

And you're not a communist now are, are you?

And you're not a communist now are, are you?

Most government expenditures are for socialist programs already.Taxes can only be used for two things - our big ass military, or socialism.

And you're not a communist now are, are you?

Its a combination of lack of education (ignorance about taxes and what they do for you and no class consciousness) and racism. The short changing of healthcare, education, and plenty of other US societal shortcomings have direct ties to anti-Black racism historically. White people are willing to march into early graves as long as other ethnicities get there first and as long as White people are considered the top of the social heirarchy.

WEB Dubois nailed it when he coined the term "the psychological wage of whiteness"

www.commondreams.org

www.commondreams.org

Outsiders are more able to look at the current state of the US objectively, and clearly its the White Americans that are being the most irresponsible citizens by their continued support for Trump and the Republican Party at large. The support is due to the above, country be damned.

WEB Dubois nailed it when he coined the term "the psychological wage of whiteness"

Deaths of Despair and the Psychological Wages of Whiteness

Racism and policies supported by a majority of poor and working-class white voters can kill them.

www.commondreams.org

www.commondreams.org

Outsiders are more able to look at the current state of the US objectively, and clearly its the White Americans that are being the most irresponsible citizens by their continued support for Trump and the Republican Party at large. The support is due to the above, country be damned.

I don't think it's lack of education regarding taxes (of which there is, for sure).

This pandemic has just made me realize how selfish us Americans can be as a nation. We generally are in favor of the betterment of society as long as it does not in anyway impede us or our desires. So from the lower class to the upper class, taxes will always be frowned upon.

This pandemic has just made me realize how selfish us Americans can be as a nation. We generally are in favor of the betterment of society as long as it does not in anyway impede us or our desires. So from the lower class to the upper class, taxes will always be frowned upon.

The USA governments spends more per capita on health care and education than other G7 nations.The short changing of healthcare, education, and plenty of other US societal shortcomings have direct ties to anti-Black racism historically.

Our civil service is fundamentally broken and needs to be accountable.

I do agree with you here, especially as a NYC resident lol. The city is run so so terribly. COVID19 just exposed a lot of it. Trash collection is a mess right now for example. Imagine cutting trash collection during a pandemic. But that's NYC for yah lol.The fact that this thread to such a immediate turn to tax revenue rather than effective government spending is indicative.

The primary failure of our two party system is that the conversation entirely surrounds how much we spend on items, press releases about how many billions we are sending due to the efforts of politicians. But by every western metric the USA is a dumpster fire at effectively spending money.

Even in the bluest of blue states our social services suck, our health care sucks, our public transit sucks, our public schools suck, our police suck. Because no one argues or fights for an effective government with accountable employees and programs, just how much we are going to spend.

The federal government already directly spends enough money on health care to provide universal health care, but no one wants to fight for reasonable costs.

It's the result of having a country full of temporarily embarrassed millionaires who think "If the Government helped people out, black people might get help and as a white person I don't like that." The Republican Party has banging the small government / taxes bad / deficit bad drum for so long most people just accept it as truth.

To further compound this issue, not only should the tax rate of the ultra rich be much much higher than it is currently, these same folks don't even pay what they SHOULD already. They're able to hide their income in other countries, corporate loopholes, etc. And only the very very rich have that ability to begin with, so the cycle continues.

Because we get fighter jets that spontaneously explode.

www.nytimes.com

www.nytimes.com

Inside America’s Dysfunctional Trillion-Dollar Fighter-Jet Program (Published 2019)

The F-35 was once the Pentagon’s high-profile problem child. Has it finally moved past its reputation of being an overhyped and underperforming warplane?

What I absolutely hate, is if you bring up universal healthcare, UBI, free college, etc people say "people just want things for free"... This is paid for by fucking taxes. It's not "Free stuff". It's only free if someone isn't working, but the majority of people work. It drives me crazy.

Scandinavia got a head start by making money selling raw materials to the Nazis but you're right nowadays it's more of a mindset issue.

People don't want to pay for others - simple as that. I've head this from both young and old people. A friend's roommate (in NYC of all places) literally asked why we are paying for other's unemployment during covid when she "works hard" - and she's like 23 not even Republican/conservative. We really, really don't like helping other people.

What I absolutely hate, is if you bring up universal healthcare, UBI, free college, etc people say "people just want things for free"... This is paid for by fucking taxes. It's not "Free stuff". It's only free if someone isn't working, but the majority of people work. It drives me crazy.

People don't want to pay for others - simple as that. I've head this from both young and old people. A friend's roommate (in NYC of all places) literally asked why we are paying for other's unemployment during covid when she "works hard" - and she's like 23 not even Republican/conservative. We really, really don't like helping other people.

I'm glad you can feed your family with military and defence technology.We get the latest in military and defense technology. Stuff ain't cheap.

We all pay for roads, bridges, police, fire, some medical, etc with our taxes yet those people never complain about that. I may never use a bridge or road in my city, but I still helped pay for it. I may never need to call the fire department, but I still pay for them. I don't get the difference between those and health care, education, etc. It makes everyone's lives better to have those things.

We all pay for roads, bridges, police, fire, some medical, etc with our taxes yet those people never complain about that. I may never use a bridge or road in my city, but I still helped pay for it. I may never need to call the fire department, but I still pay for them. I don't get the difference between those and health care, education, etc. It makes everyone's lives better to have those things.

Exactly. People complain about a "socialist" society, but we partially live in one already. It's just a worse version that is far worse for the poor and middle class. Even health insurance is somewhat socialized, because you pay premiums, regardless of whether or not you use it. It's just a terrible version that gets more money out of the consumers.

So part of the reason why we have education disparity in the US is because richer suburbs will invest in their schools through PTA donations and what not whereas in underserved communities, not only do they lack these donation mechanisms, but funding is also further cut due to low test scores.

I feel like I pay basically the same taxes as I did when I was in Canada and all I'm getting is this lousy 5 miles of border wall

Schools are funded in the US mostly by property taxes, so richer neighborhoods have more money for their schools. It's not about choosing to invest, it's about how much money they get.So part of the reason why we have education disparity in the US is because richer suburbs will invest in their schools through PTA donations and what not whereas in underserved communities, not only do they lack these donation mechanisms, but funding is also further cut due to low test scores.

And we drew a lot of those school districts in predictably racist ways.

Donation drives are just attempts to fill holes that fund cuts left, this is not something that should happen in a functioning country.

Why would the greatest country in the world, with the best form of government in the history of histories, ever need to change up anything?

Plus, the system is working for those in power or who already "got theirs", so that's another reason we see slow or nonexistent change to the status quo.

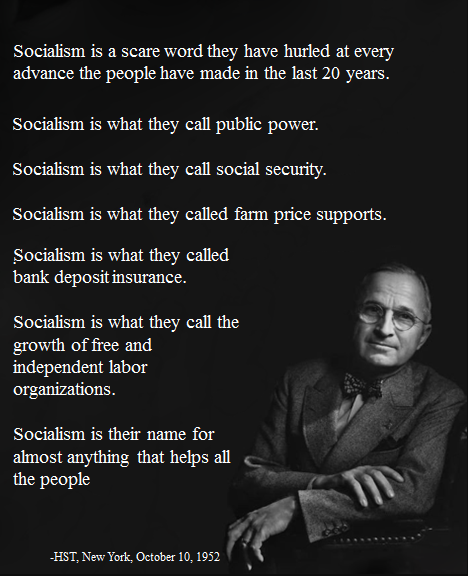

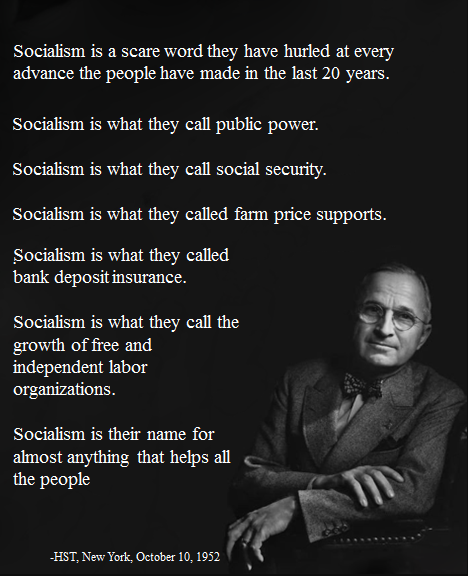

It all goes back to the eternal fight against socialism:

Harry almost gets it

Throw in a ton of racism, mix it up with a bunch of militarism, and you have the last 100 years of America punching itself in the balls.

Plus, the system is working for those in power or who already "got theirs", so that's another reason we see slow or nonexistent change to the status quo.

What I absolutely hate, is if you bring up universal healthcare, UBI, free college, etc people say "people just want things for free"... This is paid for by fucking taxes. It's not "Free stuff". It's only free if someone isn't working, but the majority of people work. It drives me crazy.

Exactly. People complain about a "socialist" society, but we partially live in one already. It's just a worse version that is far worse for the poor and middle class. Even health insurance is somewhat socialized, because you pay premiums, regardless of whether or not you use it. It's just a terrible version that gets more money out of the consumers.

It all goes back to the eternal fight against socialism:

Harry almost gets it

Throw in a ton of racism, mix it up with a bunch of militarism, and you have the last 100 years of America punching itself in the balls.

Schools are funded in the US mostly by property taxes, so richer neighborhoods have more money for their schools. It's not about choosing to invest, it's about how much money they get.

And we drew a lot of those school districts in predictably racist ways.

Donation drives are just attempts to fill holes that fund cuts left, this is not something that should happen in a functioning country.

Absolutely correct..totally forgot to mention that.

I feel like I pay basically the same taxes as I did when I was in Canada and all I'm getting is this lousy 5 miles of border wall

I know right? If you're salaried, you actually get taxed quite a bit. The only people I see talk about "tax breaks" are those that setup their own companies.

It boils down to most Americans being trained and taught to be selfish.

"Why should I have to pay for other people when I won't use it?!"

It's literally one of the core tenants of Christianity, helping the less fortunate, but heaven forbid any money be "lost" to help them when you EARNED that money and they didn't!

Decades of propaganda that "socialism bad" and exaggerating wait times when visiting the doctor in places like Canada, stressing that your overall paycheck will be less $$$ due to taxes and highlighting the Scary Brown People will benefit MUCH more than you, the "standard white person".

"Why should I have to pay for other people when I won't use it?!"

It's literally one of the core tenants of Christianity, helping the less fortunate, but heaven forbid any money be "lost" to help them when you EARNED that money and they didn't!

Decades of propaganda that "socialism bad" and exaggerating wait times when visiting the doctor in places like Canada, stressing that your overall paycheck will be less $$$ due to taxes and highlighting the Scary Brown People will benefit MUCH more than you, the "standard white person".

I've always been under the assumption that the US barely have any taxes at all tbh.

Though I live in the country with the highest taxes in the world and here it's one of the biggest discussion points in politics and day-to-day conversations on what taxes should and shouldn't be spent on.

I think in general you care more about taxes if they take up a greater percentage of your income.

Though I live in the country with the highest taxes in the world and here it's one of the biggest discussion points in politics and day-to-day conversations on what taxes should and shouldn't be spent on.

I think in general you care more about taxes if they take up a greater percentage of your income.

75% of the federal budget goes to the military, social security, and medicare. As a salaried employee, you don't see any of those benefits unless you work in the defense industry or you're above the age of 65.

I've always been under the assumption that the US barely have any taxes at all tbh.

I've seen a handful of articles that tried to estimate the % of total income people in the US pay on average for their taxes (excluding sales tax), and it ranges from 15% to 25%.

If you're self-employed, you pay 15.3% of your total income for social security and medicare (if you're an employee, the employer pays half of that) before you even pay other federal or state taxes (and state taxes vary wildly from like 0% to 12% based on the state).

Last edited:

I've always been under the assumption that the US barely have any taxes at all tbh.

Though I live in the country with the highest taxes in the world and here it's one of the biggest discussion points in politics and day-to-day conversations on what taxes should and shouldn't be spent on.

I think in general you care more about taxes if they take up a greater percentage of your income.

Yeah, USA actually has a shit ton of taxes. It's just that the tax system is actually regressive these days after 40+ years of reaganomics.

Opinion | How to Tax Our Way Back to Justice (Published 2019)

It is absurd that the working class is now paying higher tax rates than the richest people in America.

America's soaring inequality has a new engine: its regressive tax system. Over the past half century, even as their wealth rose to previously unseen heights, the richest Americans watched their tax rates collapse. For the working classes over the same period, as wages stagnated, work conditions deteriorated and debts ballooned, tax rates increased.

Stop to think this over for a minute: For the first time in the past hundred years, the working class — the 50 percent of Americans with the lowest incomes — today pays higher tax rates than billionaires.

You will often hear that we have a progressive tax system in the United States — you owe more, as a fraction of your income, as you earn more. When he was a presidential candidate in 2012, Senator Mitt Romney famously lambasted the 47 percent of "takers" who, according to him, do not contribute to the public coffers. In reality, the bottom half of the income distribution may not pay much in income taxes, but it pays a lot in sales and payroll taxes. Taking into account all taxes paid, each group contributes between 25 percent and 30 percent of its income to the community's needs. The only exception is the billionaires, who pay a tax rate of 23 percent, less than every other group.

The tax system in the United States has become a giant flat tax — except at the top, where it's regressive. The notion that America, even if it may not collect as much in taxes as European countries, at least does so in a progressive way, is a myth. As a group, and although their individual situations are not all the same, the Trumps, the Bezoses and the Buffetts of this world pay lower tax rates than teachers and secretaries do.

This is the tax system of a plutocracy. With tax rates of barely 23 percent at the top of the pyramid, wealth will keep accumulating with hardly any barrier. So, too, will the power of the wealthy, including their ability to shape policymaking and government for their own benefit.

Many aren't aware of this, not that there's much an individual can do about this. And that's exactly what the rich want; they want an overly complicated and wasteful bureaucracy that is too difficult to even try to reform or change.

They want the poor to be taxed more and services to be cut at the same time. They want the military industrial complex to continue thriving, something even an imperialist, foreign coup loving racist Repub like Eisenhower was warning the country against.

Hell, collectively as a country we don't even blink at the $2 trillion wasted in just Afghanistan alone over 20 years. It's just something we have to accept while expecting more of it in the future. Same for all the money we've let go to waste in healthcare.

I think it totals to around 52-57% in Sweden, which is substantially more tbh. But yeah then we get benefits like paid maternity and paternity leave, free dental care until a certain age and free university education among other stuff.I've seen a handful of articles that tried to estimate the % of total income people in the US pay on average for their taxes (excluding sales tax), and it ranges from 15% to 25%.

In general it's good to always be critical of what governments are doing with "your" money, though sadly the discourse nowadays always bounce back to "immigrants stealing our taxmoney".

Damn this was fuck rough to read :/ not even an attempt to balance the income gaps but rather to work to even further increase themYeah, USA actually has a shit ton of taxes. It's just that the tax system is actually regressive these days after 40+ years of reaganomics.

Opinion | How to Tax Our Way Back to Justice (Published 2019)

It is absurd that the working class is now paying higher tax rates than the richest people in America.www.nytimes.com

Many aren't aware of this, not that there's much an individual can do about this. And that's exactly what the rich want; they want an overly complicated and wasteful bureaucracy that is too difficult to even try to reform or change.

They want the poor to be taxed more and services to be cut at the same time. They want the military industrial complex to continue thriving, something even an imperialist, foreign coup loving racist Repub like Eisenhower was warning the country against.

Hell, collectively as a country we don't even blink at the $2 trillion wasted in just Afghanistan alone over 20 years. It's just something we have to accept while expecting more of it in the future. Same for all the money we've let go to waste in healthcare.

Government services have been demonized in the US for decades. If you need government help for any reason, then you "failed" morally as a good citizen. You need to grab your bootstraps and be totally independent from government, lest you be a despicable leech on society. So paying taxes to help these "leeches" is very frowned upon in American culture. Better their taxes go to subsidize oil and gas companies or fund Wall Street bailouts than funding Medicaid so poor people can have healthcare or increase Pell grants so people can better afford a college education.