Guys, everywhere is hurting even if you're in stocks. Yesterday Upstart fell 50% in one day. Netflix and PayPal are down 70% in the last year. There's nowhere to hide if you're invested in equities and correlated assets.

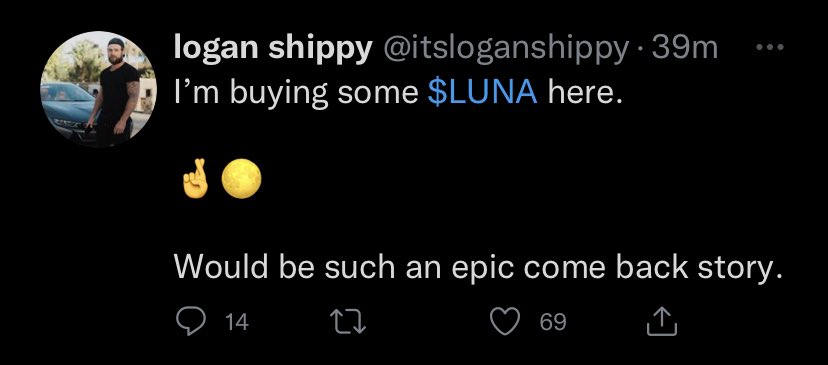

The real criticism of crypto these days is that there were too many influencers hyping nonsense like "Bitcoin isn't correlated to the stock market", "a bull market is coming soon", "when in doubt, zoom out" etc. It kept people from being properly diversified and questioning projects.

For those who want other videos explaining why Terra was always going to fail (aside from CoinBureau from a couple months ago)

When the stock market falls, crypto falls with it even harder. And when you have crap like Terra that a lot of projects are invested in, it's going to drag the market down with it.

And while investing in bear markets can yield great profits when the market gets going again, you have to be careful in assuming everything will go up. In stocks, look at Cisco. In crypto, look at altcoins in bear markets: most of them do not make it out of the old cycle. Bitcoin has the name recognition, maybe ethereum. Everything else isn't guaranteed.

And on top of that, this downswing is far from over. We are likely going into a recession if we aren't in one already, which could result in a bear market for months and years in stocks and crypto.

Stay safe, stay diversified and never invest more than you can afford to lose.