-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

Stock Market Watch |OT| I've stocked up on market watches, what now?

- Thread starter Mr.Awesome

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

also, with Quadruple witching on Friday, there will be a lot of weird moves probably in the next two days at the open and close. Probably had something to do with the close today. Wonder if Wall Street will want to pay out all the Put holders on Friday or where there be some shenanigans I bet.

I don't know if this is stupid or not but TSLA hit my Limit Order I set up last week at $355, so that was a good chunk of my spending money I had to sit on (on top of my reoccurring contributions). Just waiting on Disney and Microsoft to hit my other orders and then I'm sitting.

100% guess I think we might see 11k. But I'll start doing big buys at 15k. I'm doing a bit of buying for every thousand, but it's not adding up to much.What's the lowest you're expecting Dow to go? Just for fun, make your predictions.

I feel like we are, as bad as it sounds, pretty far away from bottom. I'm expecting 12k at the very bottom.

And you guys?

Tesla will easily be going below 250 in the coming months. I don't usually say numbers with that much certainty, but....I don't know if this is stupid or not but TSLA hit my Limit Order I set up last week at $355, so that was a good chunk of my spending money I had to sit on (on top of my reoccurring contributions). Just waiting on Disney and Microsoft to hit my other orders and then I'm sitting.

14k maybe. Really hard to say though. A month ago I never would have made that guess.What's the lowest you're expecting Dow to go? Just for fun, make your predictions.

I feel like we are, as bad as it sounds, pretty far away from the absolute bottom. I'm expecting 12k at the very bottom.

'bout you guys?

Same but I think I need to give it a rest at least til April. Every deal I've grabbed has turned out to not be a deal. I find comfort in being only 30 and having no need to cash out.I'm doing a bit of buying for every thousand, but it's not adding up to much.

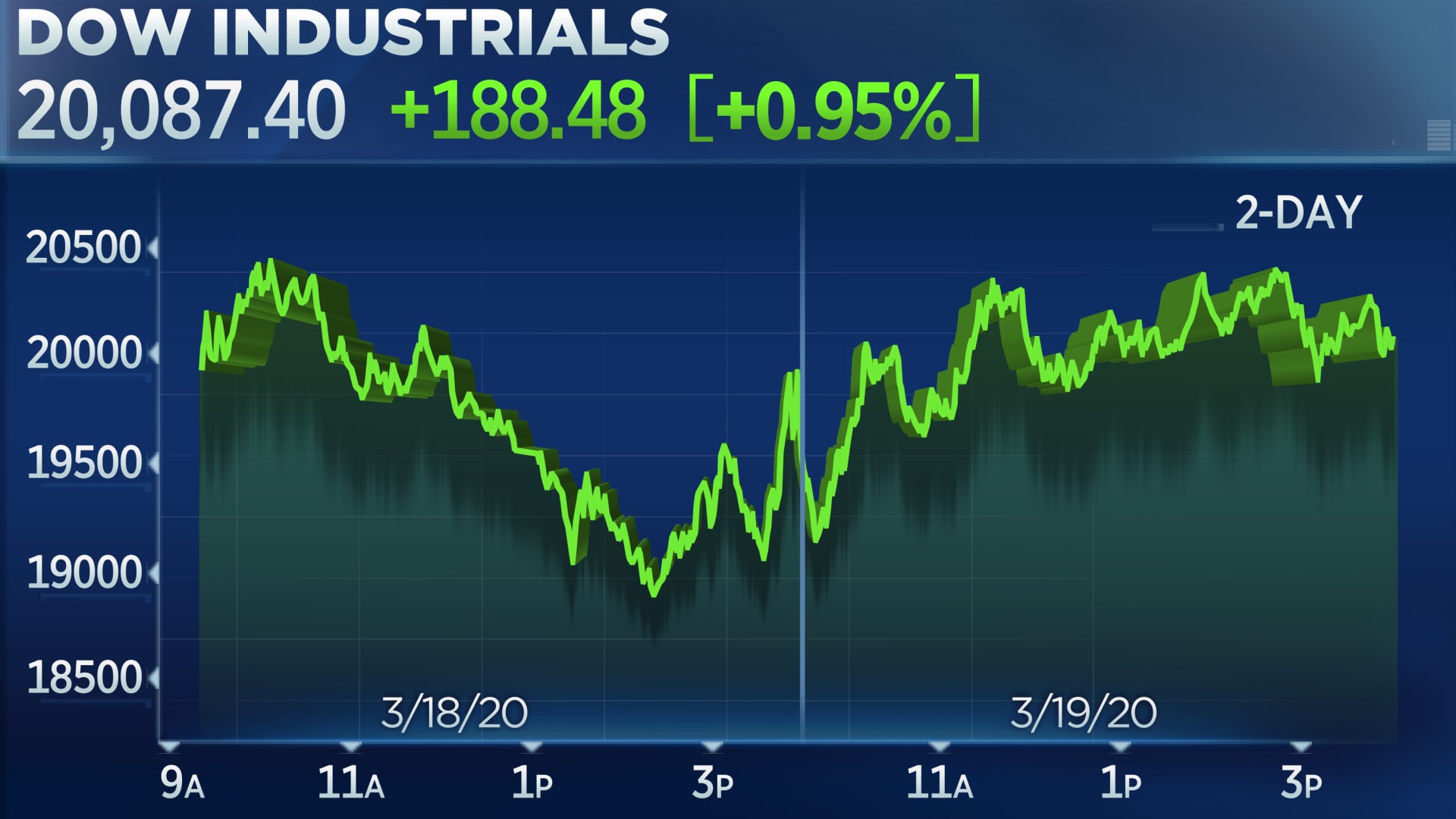

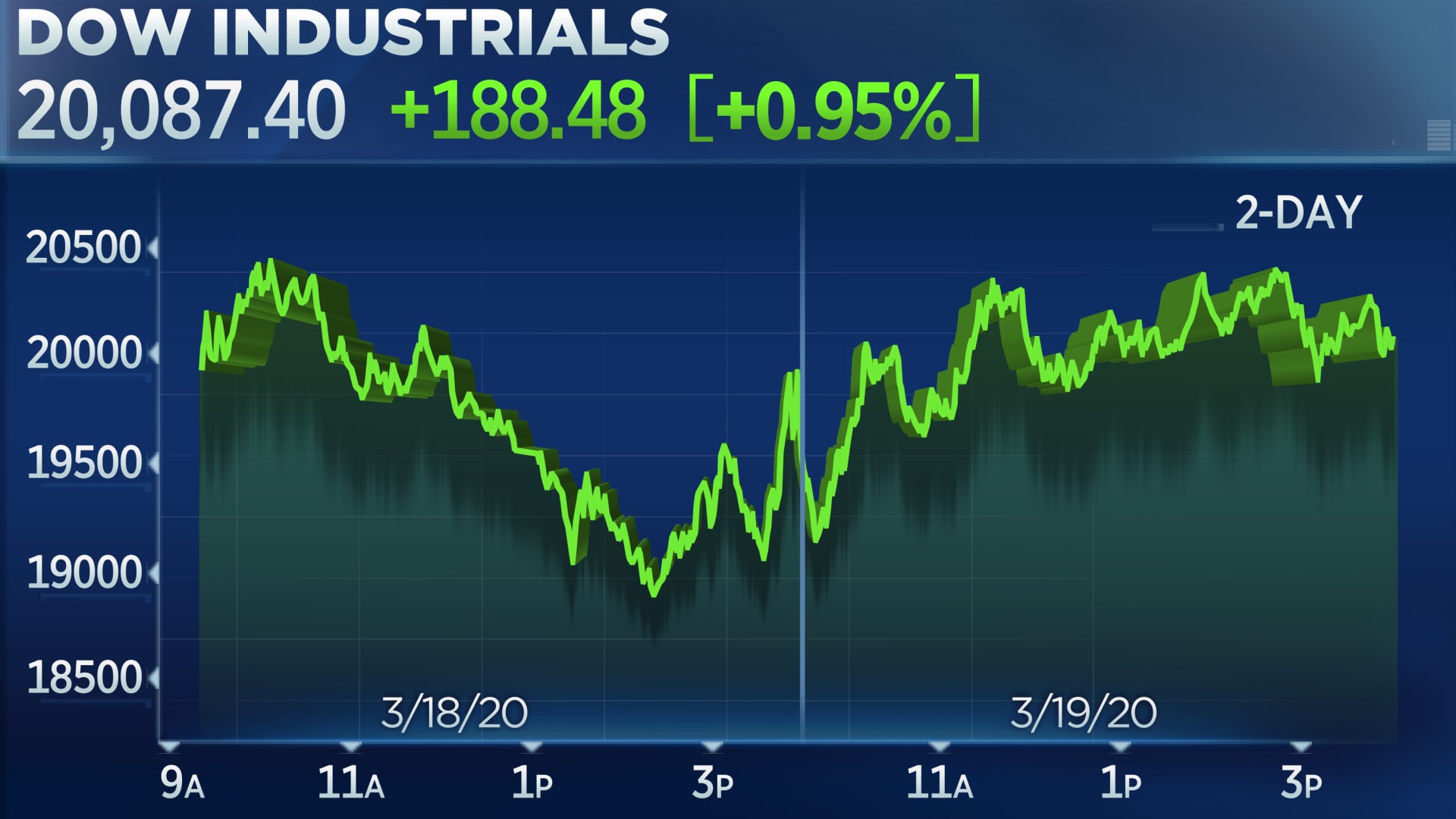

Trump should be bragging about that monster 5.5% rally today.

Not counting the first 5 hours I mean.

Not counting the first 5 hours I mean.

Oh you are probably right, I can either dump it if it goes up much or hold on long term. I'm not super picky. At least I'm not buying at 900+ :/100% guess I think we might see 11k. But I'll start doing big buys at 15k. I'm doing a bit of buying for every thousand, but it's not adding up to much.

Tesla will easily be going below 250 in the coming months. I don't usually say numbers with that much certainty, but....

Yeah, I also see Tesla tanking in the short term. Their recent rally was fueled by memes and an inflated bull market. Now that we're coming back down to reality I don't see how anyone can justify that share price. Musk was smart to raise another $2 billion at the top last month.

...once it does drop, though, I'll probably buy some. Long term I still see huge potential.

...once it does drop, though, I'll probably buy some. Long term I still see huge potential.

BS, can't really trust any numbers. All speculationwhat the hell are these numbers. How can they even have predictions when we don't even know how long or bad this will get.

I personally think the "bottom" is 9800. But that's just my hunch.

There is no bottom. Banks still haven't defaulted.

Looks like floor trading will be halted starting Monday and the NYSE will transition to fully-electronic trading for the foreseeable future due to positive COVID tests on the floor.

www.cnbc.com

www.cnbc.com

NYSE to temporarily close floor, move to electronic trading after positive coronavirus tests

The closure was in part as a result of positive coronavirus tests of two people, Stacey Cunningham, President of the NYSE, told CNBC.

Looks like floor trading will be halted starting Monday and the NYSE will transition to fully-electronic trading for the foreseeable future due to positive COVID tests on the floor.

Lovely

So we can expect even more jank and wild swinging. lovely.Looks like floor trading will be halted starting Monday and the NYSE will transition to fully-electronic trading for the foreseeable future due to positive COVID tests on the floor.

NYSE to temporarily close floor, move to electronic trading after positive coronavirus tests

The closure was in part as a result of positive coronavirus tests of two people, Stacey Cunningham, President of the NYSE, told CNBC.www.cnbc.com

Looks like floor trading will be halted starting Monday and the NYSE will transition to fully-electronic trading for the foreseeable future due to positive COVID tests on the floor.

NYSE to temporarily close floor, move to electronic trading after positive coronavirus tests

The closure was in part as a result of positive coronavirus tests of two people, Stacey Cunningham, President of the NYSE, told CNBC.www.cnbc.com

Sounds like they didn't make it to the floor, though. Did I read that part right?

Yes stopped right before it I guess. But obviously it was enough to make this move. Was a matter of time, really.Sounds like they didn't make it to the floor, though. Did I read that part right?

So Fidelity has a big banner after you logon about "navigating a volatile market". Small bit of comfort for someone who has lost possibly hundreds of thousands at this point. Still glad I moved everything to a fixed savings. Haven't lost a dime since then (obviously, I mean how could I).

just focus on how incredibly lucky you are to have that much money to lose in the first place.So Fidelity has a big banner after you logon about "navigating a volatile market". Small bit of comfort for someone who has lost possibly hundreds of thousands at this point. Still glad I moved everything to a fixed savings. Haven't lost a dime since then (obviously, I mean how could I).

just focus on how incredibly lucky you are to have that much money to lose in the first place.

Oh I didn't lose much. I got out early. I mean I get your point and all.

It was like 2% of my retirement, the rest of which has been in cash and bonds since March 2.

Of course it's like 5% now!

It was like 2% of my retirement, the rest of which has been in cash and bonds since March 2.

Of course it's like 5% now!

Muy bueno.

What's the lowest you're expecting Dow to go? Just for fun, make your predictions.

I feel like we are, as bad as it sounds, pretty far away from the absolute bottom. I'm expecting 12k at the very bottom.

'bout you guys?

I'm not a market expert or anything but it all depends how long this damn virus lasts. As of right now, unlike 2008, nobody appears to be sitting on a bunch of toxic assets - yet.

I work in commercial banking so it seems to me like it's a matter of how long cash reserves will be keeping "AAA" credits afloat so they can pay their workers and keep making their debt payments.

Once shit starts defaulting across the board who knows where the bottom will be if banks start failing too?

You figured out the exact reason I went for it. This is my first time so I decided to take a risk with some money I was willing to part with.Yeah I gotta say, didn't expect volatility to jump ANOTHER 40% overnight.

Didn't know about UVXY. Great less expensive if you don't think TVIX is risky enough!

For someone who deals exclusively in diversified mutual funds, is there really a better strategy now than continuing to invest on a regular basis (previously set up with automatic transactions), along with buying index funds manually every so often as the market drops lower?

I'm buy-and-hold, although I've got enough to play around with if I had the inclination. But for conflict of interest and financial disclosure reasons, I don't want to hold individual companies.

What are the appeals of TIVX and UVXY? (Like, I'm literally VTSAX/VTIAX basically, plus some USAA funds.)

I'm buy-and-hold, although I've got enough to play around with if I had the inclination. But for conflict of interest and financial disclosure reasons, I don't want to hold individual companies.

What are the appeals of TIVX and UVXY? (Like, I'm literally VTSAX/VTIAX basically, plus some USAA funds.)

Looks like floor trading will be halted starting Monday and the NYSE will transition to fully-electronic trading for the foreseeable future due to positive COVID tests on the floor.

NYSE to temporarily close floor, move to electronic trading after positive coronavirus tests

The closure was in part as a result of positive coronavirus tests of two people, Stacey Cunningham, President of the NYSE, told CNBC.www.cnbc.com

They should have suspended floor trading on Monday, along with everything else in the country

Gambling on volatility basically. There have been plays on it, but it's crazy ballooned right now, I wouldn't touch it. There's too much 'easy' money to take instead of trading that imo.For someone who deals exclusively in diversified mutual funds, is there really a better strategy now than continuing to invest on a regular basis (previously set up with automatic transactions), along with buying index funds manually every so often as the market drops lower?

I'm buy-and-hold, although I've got enough to play around with if I had the inclination. But for conflict of interest and financial disclosure reasons, I don't want to hold individual companies.

What are the appeals of TIVX and UVXY? (Like, I'm literally VTSAX/VTIAX basically, plus some USAA funds.)

Could purchase Oil and Silver ETFs if you were inclined, or ETFs like SPY if that's not in conflict of interest.

Thanks for the reply! Any particular benefit to SPY vs. VTSAX since the latter also contains mid- and small-cap holdings? I've never dealt with ETFs before. My investing strategy is mostly just Bogle-based, but fueled by laziness.Gambling on volatility basically. There have been plays on it, but it's crazy ballooned right now, I wouldn't touch it. There's too much 'easy' money to take instead of trading that imo.

Could purchase Oil and Silver ETFs if you were inclined, or ETFs like SPY if that's not in conflict of interest.

I'm now a couple thousand below my 401K rollover origination balance from a few years ago.

:(

:(

I do think we're a long way from the bottom, however the speed of the drop right now probably has something to do with the advancement of automated, and algorithmic trading. Things just happen faster in the stock market now.The 2008 financial crisis didn't bottom out in a couple of months. It was well over a year, closer to a year and half before it hit rock bottom. This crash could still be a long way away from the bottom.

I'm now a couple thousand below my 401K rollover origination balance from a few years ago.

:(

Mine's back where it was in 2018 when I had to give 30k to my ex.

No.For someone who deals exclusively in diversified mutual funds, is there really a better strategy now than continuing to invest on a regular basis (previously set up with automatic transactions), along with buying index funds manually every so often as the market drops lower?

I'm now a couple thousand below my 401K rollover origination balance from a few years ago.

:(

focus on numbers of shares not dollar value. hang in there

How do mutual fund managers handle this stuff?

Are they swapping out anything and changing stock/bond ratios right now? Or is it just stick to the plan?

Are they swapping out anything and changing stock/bond ratios right now? Or is it just stick to the plan?

I'd like to see polling about his approval ratings a few weeks from now when shit gets worse, unless people were already polled

Good evening y'all. Time to plan out my moves for the end of the week, it's gonna be open season so here's some advice:

So I'm sure you all already know about SPY, right? For those who don't, it's basically an ETF that tracks the S&P 500. The corona virus crisis plus the weak American economy has caused it to drop steadily, and those who know how to trade options have been making a killing off of buying puts.

But Thursday and Friday will be different. Why? Because this Friday, over 6 million options on SPY are set to expire. Because SPY has been dropping so hard the past week, that means many of those SPY put options are set to expire in-the-money (ITM). For anyone who knows about options, when an option is about to expire ITM, the broker of the person holding the option will exercise it for them automatically, which means they buy the shares on the market and then sell them to the option seller for the strike price, collecting the profit. That means for all those put options, there's going to be a massive wave of buy orders coming in because brokers are automatically exercising contracts. This will drive up the price of SPY because there will be more buyers than sellers.

But wait, there's more. There will be a big number of options sellers buying SPY for delta hedging purposes (lots of math, not gonna explain), as well as day traders who are too chicken to hold their positions through the weekend. All these things together will result one hell of a short squeeze, and SPY will rally hard on Friday.

More on short squeezes: https://en.wikipedia.org/wiki/Short_squeeze

So here's the play:

I think this short squeeze is gonna happen and pump the price of SPY extremely hard. So what I'm gonna do is buy SPY calls at 270-275 expiring 3/27, that far out primarily to avoid theta decay. The goal is to see what happens with futures and how the market opens tomorrow morning. If it opens green, buy right away. If it opens red, let it dip and then buy to pay less premium.

Then when the witching hour happens (expected about 30 minutes before close), ride the wave up, then quickly sell those calls, and quickly buy SPY puts at 220, expiring 4/17. You'll get them for ultra cheap due to the short squeeze. If corona gets worse (which it probably will), then we'll have more red days to come, and I make money both ways, essentially taking advantage of the market movements and the ongoing crises for massive dollars.

So I could be a genius, I could be totally wrong, but I'll certainly try.

So I'm sure you all already know about SPY, right? For those who don't, it's basically an ETF that tracks the S&P 500. The corona virus crisis plus the weak American economy has caused it to drop steadily, and those who know how to trade options have been making a killing off of buying puts.

But Thursday and Friday will be different. Why? Because this Friday, over 6 million options on SPY are set to expire. Because SPY has been dropping so hard the past week, that means many of those SPY put options are set to expire in-the-money (ITM). For anyone who knows about options, when an option is about to expire ITM, the broker of the person holding the option will exercise it for them automatically, which means they buy the shares on the market and then sell them to the option seller for the strike price, collecting the profit. That means for all those put options, there's going to be a massive wave of buy orders coming in because brokers are automatically exercising contracts. This will drive up the price of SPY because there will be more buyers than sellers.

But wait, there's more. There will be a big number of options sellers buying SPY for delta hedging purposes (lots of math, not gonna explain), as well as day traders who are too chicken to hold their positions through the weekend. All these things together will result one hell of a short squeeze, and SPY will rally hard on Friday.

More on short squeezes: https://en.wikipedia.org/wiki/Short_squeeze

So here's the play:

I think this short squeeze is gonna happen and pump the price of SPY extremely hard. So what I'm gonna do is buy SPY calls at 270-275 expiring 3/27, that far out primarily to avoid theta decay. The goal is to see what happens with futures and how the market opens tomorrow morning. If it opens green, buy right away. If it opens red, let it dip and then buy to pay less premium.

Then when the witching hour happens (expected about 30 minutes before close), ride the wave up, then quickly sell those calls, and quickly buy SPY puts at 220, expiring 4/17. You'll get them for ultra cheap due to the short squeeze. If corona gets worse (which it probably will), then we'll have more red days to come, and I make money both ways, essentially taking advantage of the market movements and the ongoing crises for massive dollars.

So I could be a genius, I could be totally wrong, but I'll certainly try.

ECB announces massive stimulus. Futures up 500 point gain so far. Investing only shows 300 points probably because of fair value of futures is -200. Details are light at the moment.

www.cnbc.com

www.cnbc.com

Dow rises more than 100 points in rebound from 3-year low, tech and energy shares lead

Stocks jumped Thursday, erasing steep losses from earlier in the day as strong gains in big-tech shares led to a sharp turnaround.

ECB is buying 750bn in Eurozone assets

www.ecb.europa.eu

www.ecb.europa.eu

ECB announces €750 billion Pandemic Emergency Purchase Programme (PEPP)

The European Central Bank (ECB) is the central bank of the European Union countries which have adopted the euro. Our main task is to maintain price stability in the euro area and so preserve the purchasing power of the single currency.

Good evening y'all. Time to plan out my moves for the end of the week, it's gonna be open season so here's some advice:

So I'm sure you all already know about SPY, right? For those who don't, it's basically an ETF that tracks the S&P 500. The corona virus crisis plus the weak American economy has caused it to drop steadily, and those who know how to trade options have been making a killing off of buying puts.

But Thursday and Friday will be different. Why? Because this Friday, over 6 million options on SPY are set to expire. Because SPY has been dropping so hard the past week, that means many of those SPY put options are set to expire in-the-money (ITM). For anyone who knows about options, when an option is about to expire ITM, the broker of the person holding the option will exercise it for them automatically, which means they buy the shares on the market and then sell them to the option seller for the strike price, collecting the profit. That means for all those put options, there's going to be a massive wave of buy orders coming in because brokers are automatically exercising contracts. This will drive up the price of SPY because there will be more buyers than sellers.

But wait, there's more. There will be a big number of options sellers buying SPY for delta hedging purposes (lots of math, not gonna explain), as well as day traders who are too chicken to hold their positions through the weekend. All these things together will result one hell of a short squeeze, and SPY will rally hard on Friday.

More on short squeezes: https://en.wikipedia.org/wiki/Short_squeeze

So here's the play:

I think this short squeeze is gonna happen and pump the price of SPY extremely hard. So what I'm gonna do is buy SPY calls at 270-275 expiring 3/27, that far out primarily to avoid theta decay. The goal is to see what happens with futures and how the market opens tomorrow morning. If it opens green, buy right away. If it opens red, let it dip and then buy to pay less premium.

Then when the witching hour happens (expected about 30 minutes before close), ride the wave up, then quickly sell those calls, and quickly buy SPY puts at 220, expiring 4/17. You'll get them for ultra cheap due to the short squeeze. If corona gets worse (which it probably will), then we'll have more red days to come, and I make money both ways, essentially taking advantage of the market movements and the ongoing crises for massive dollars.

So I could be a genius, I could be totally wrong, but I'll certainly try.

Yeah I've been talking about quadruple witching on Friday and how there will be some weird price actions probably tomorrow and friday. Probably first thing in the open and then 5 minutes to close each day with Friday probably going to be bonkers with stocks going up or down 5-10% depending on things. Apple usually goes down because they buy back so much stock they have to rebalance the SPY index and Apple is a net seller but who knows now with everything being destroyed what will happen. I may or may not participate but I'll definitely have my popcorn to watch the Friday close.

Depends on the fund rules. I know some mutual funds were required to to have stop losses applied, so they would have went to cash after a certain amount of loss. I imagine most didn't have such rules. Some can only have a certain percentage of cash or bonds as well, so probably most stuck to the plan and are waiting it out.How do mutual fund managers handle this stuff?

Are they swapping out anything and changing stock/bond ratios right now? Or is it just stick to the plan?

Mutual fund managers are probably shitting bricks now and getting all sorts of nervous phone calls.

How do you know how many expiring options there are? How do you know that the buying flurry is enough to move the needle overall?Good evening y'all. Time to plan out my moves for the end of the week, it's gonna be open season so here's some advice:

So I'm sure you all already know about SPY, right? For those who don't, it's basically an ETF that tracks the S&P 500. The corona virus crisis plus the weak American economy has caused it to drop steadily, and those who know how to trade options have been making a killing off of buying puts.

But Thursday and Friday will be different. Why? Because this Friday, over 6 million options on SPY are set to expire. Because SPY has been dropping so hard the past week, that means many of those SPY put options are set to expire in-the-money (ITM). For anyone who knows about options, when an option is about to expire ITM, the broker of the person holding the option will exercise it for them automatically, which means they buy the shares on the market and then sell them to the option seller for the strike price, collecting the profit. That means for all those put options, there's going to be a massive wave of buy orders coming in because brokers are automatically exercising contracts. This will drive up the price of SPY because there will be more buyers than sellers.

But wait, there's more. There will be a big number of options sellers buying SPY for delta hedging purposes (lots of math, not gonna explain), as well as day traders who are too chicken to hold their positions through the weekend. All these things together will result one hell of a short squeeze, and SPY will rally hard on Friday.

More on short squeezes: https://en.wikipedia.org/wiki/Short_squeeze

So here's the play:

I think this short squeeze is gonna happen and pump the price of SPY extremely hard. So what I'm gonna do is buy SPY calls at 270-275 expiring 3/27, that far out primarily to avoid theta decay. The goal is to see what happens with futures and how the market opens tomorrow morning. If it opens green, buy right away. If it opens red, let it dip and then buy to pay less premium.

Then when the witching hour happens (expected about 30 minutes before close), ride the wave up, then quickly sell those calls, and quickly buy SPY puts at 220, expiring 4/17. You'll get them for ultra cheap due to the short squeeze. If corona gets worse (which it probably will), then we'll have more red days to come, and I make money both ways, essentially taking advantage of the market movements and the ongoing crises for massive dollars.

So I could be a genius, I could be totally wrong, but I'll certainly try.

Legit questions btw, I know very little about option trading.

- Status

- Not open for further replies.