Ah, thats good.No it's not a big deal because we only have like 40 employees.

-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

Retirement-Era |OT| How to Invest For Retirement

- Thread starter TheTrinity

- Start date

- OT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sure, but that doesn't change the facts that recession indicators are starting to show.

Yield curve was inverted earlier in this bull cycle. CAPE10 has been higher in the cycle. Concerns about decelerating growth in China was an issue 3-4 years ago as well. Is there a specific indicator you are concerned about?

Not to mention that recessions are a natural thing that come around about every 10 years.

The durations of the bull markets since the Great Depression (excluding the current one): 6, 5, 7, 8, 5, 5, 3, 4, 7, 6, 4, 10, and 6 years. The average works out to 5.8 years. If you followed the average, you would have bailed out in 2015.

PMI has been a red flag this year. The feds recent cut. Pretty much the entire banking sector, including that of Europe. Looking at you Deutsche Bank. China's continued slow down. Trade wars. The fact that while the S&P 500 has continued to make new all time highs this year, the Small caps (Russell 2000) has visibly lagged behind this move. Not even getting close to making it to ath. Then you have the banking sector also not confirming the move in the s&p. Basically there are signs that things are not well. Do i think things will got to shit in the immediate? Not to sure as we are range bound. Similar to that of last year. Oct - dec.Yield curve was inverted earlier in this bull cycle. CAPE10 has been higher in the cycle. Concerns about decelerating growth in China was an issue 3-4 years ago as well. Is there a specific indicator you are concerned about?

The durations of the bull markets since the Great Depression (excluding the current one): 6, 5, 7, 8, 5, 5, 3, 4, 7, 6, 4, 10, and 6 years. The average works out to 5.8 years. If you followed the average, you would have bailed out in 2015.

As for the yield curve all i can find was the last time it happening 2 years before 2008. If you don't mind sharing your source on it happening this cycle so i can review it. Now if you mean late 2018 when it did briefly, if using that. In theory we'd have a recession aroun 10 to 18 months after.

Unfortunately i did not trade in 2015, so other than looking at some charts. All i can say is i understand why that was the thought.

As for the yield curve all i can find was the last time it happening 2 years before 2008. If you don't mind sharing your source on it happening this cycle so i can review it. Now if you mean late 2018 when it did briefly, if using that. In theory we'd have a recession aroun 10 to 18 months after.

Yes I was referring to 2018. Regardless of it potentially being a leading indicator, it reversed after a couple of weeks so that ought to tell that it is not a particularly reliable predictor, unless we get a recession that only lasts a couple weeks.

My broader point is not that the economy is bulletproof, but that a lot of these indicators are of extremely poor quality. Most of them were discovered via back-testing, which is notorious for declaring statistical anomalies as being significant and leading to overfitting in models.

I've got a quick question regarding 401k loans.

CLIFF NOTES

Earlier this year, I took a loan from my 401k to hire a lawyer for a custody fight ($4k). I have since been laid off from that company and fully vested. Can I pay off the 401k loan with the other portion of my 401k? I'm presuming I'd have to take a penalty for early withdrawl. The only reason I'm considering this is that from what I'm reading I have to pay off the balance by tax season or get an automatic penalty. I've since started a new job with much better 401k options so I'm not as worried about the funds depleting.

I realize messing with 401k isn't always the best thing, but it's the only option my family had available at the time. I just want to make sure I'm understanding things correctly. I've read it's one month, I've read until tax time.

QUESTION

As my credit isn't good enough (and I don't want to borrow more money to be honest) should I withdraw the remainder of the 401k funds to pay off the loan and start aggressively contributing under the new 401k plan? I can't rollover the loan I'm presuming :D I'm ok with the penalty for withdrawing to pay off the loan (as opposed to a potential default situation which will assess a penalty automatically)

Any advice would be greatly appreciated. Thanks!

CLIFF NOTES

Earlier this year, I took a loan from my 401k to hire a lawyer for a custody fight ($4k). I have since been laid off from that company and fully vested. Can I pay off the 401k loan with the other portion of my 401k? I'm presuming I'd have to take a penalty for early withdrawl. The only reason I'm considering this is that from what I'm reading I have to pay off the balance by tax season or get an automatic penalty. I've since started a new job with much better 401k options so I'm not as worried about the funds depleting.

I realize messing with 401k isn't always the best thing, but it's the only option my family had available at the time. I just want to make sure I'm understanding things correctly. I've read it's one month, I've read until tax time.

QUESTION

As my credit isn't good enough (and I don't want to borrow more money to be honest) should I withdraw the remainder of the 401k funds to pay off the loan and start aggressively contributing under the new 401k plan? I can't rollover the loan I'm presuming :D I'm ok with the penalty for withdrawing to pay off the loan (as opposed to a potential default situation which will assess a penalty automatically)

Any advice would be greatly appreciated. Thanks!

I've got a quick question regarding 401k loans.

CLIFF NOTES

Earlier this year, I took a loan from my 401k to hire a lawyer for a custody fight ($4k). I have since been laid off from that company and fully vested. Can I pay off the 401k loan with the other portion of my 401k? I'm presuming I'd have to take a penalty for early withdrawl. The only reason I'm considering this is that from what I'm reading I have to pay off the balance by tax season or get an automatic penalty. I've since started a new job with much better 401k options so I'm not as worried about the funds depleting.

I realize messing with 401k isn't always the best thing, but it's the only option my family had available at the time. I just want to make sure I'm understanding things correctly. I've read it's one month, I've read until tax time.

QUESTION

As my credit isn't good enough (and I don't want to borrow more money to be honest) should I withdraw the remainder of the 401k funds to pay off the loan and start aggressively contributing under the new 401k plan? I can't rollover the loan I'm presuming :D I'm ok with the penalty for withdrawing to pay off the loan (as opposed to a potential default situation which will assess a penalty automatically)

Any advice would be greatly appreciated. Thanks!

How long ago did you leave that job? What was your balance in the 401k? The loan?

Rollovers are determined by the plan docs so if you can or not will be determined by the new plan.

If you don't pay off a loan the amount of the loan is distributed to you and you would have to recognize income.

Hahaha we use Voya at my work. Their sites are terrible. Not sure about your job, but at mine, people have to go through HR (meaning me) to change their contribution.

We also have Voya and I can change my contribution on the website myself. I couldn't imagine having to go through HR for that.

Ugh, I've been putting money into a roth IRA and a general index fund since early 2018, and I've been losing money on it the whole time. I know that I'm a long way out from retirement, but it still doesn't feel good to see that ~%40 of the money I've put in is just gone.

What kind of index fund is this? S&P500 is even/up since early 2018:Ugh, I've been putting money into a roth IRA and a general index fund since early 2018, and I've been losing money on it the whole time. I know that I'm a long way out from retirement, but it still doesn't feel good to see that ~%40 of the money I've put in is just gone.

Yeah my cumulative returns are definitely up since early 2018. Being down 40% in that time doesn't sound right at all.

Trying to decide if I should pay off all or most of my vehicle (about $18K on the loan) with savings that I have in a non-retirement investment account. I'm not trying to time the market, but there's a lot of speculation of a recession (more than usual.. people have been saying this for years). If I paid it off, I'd have that money available per month to either invest or put into savings. :|

IDK, that's what Mint is telling me, maybe it's lying. Looking through Vanguard I can't see where it's getting that from. The index fund is VASGX and the IRA is VTTSX.

Can you maybe post a picture of your value line (with blocking out the numerical values on the axis if you want) so we can see what it's showing you?

Sometimes Mint/portfolio managers have trouble with the dates being slightly off which especially with the end of 2018 being a big dip either screws your 2019 return or your 2018 return, but overall you should at this point definitely not be down still.

Trying to decide if I should pay off all or most of my vehicle (about $18K on the loan) with savings that I have in a non-retirement investment account. I'm not trying to time the market, but there's a lot of speculation of a recession (more than usual.. people have been saying this for years). If I paid it off, I'd have that money available per month to either invest or put into savings. :|

That's literally what timing the market is :D

Lol, I know, but it's not some master scheme to get rich. I'm just trying to decide if using some of that money now would be better in this one circumstance, in case the market does take a nose dive. It would be a one-time thing, trying to put some of that money to good use. Yes, it's sort of timing the market, but when I hear timing the market, I think of day traders trying to buy low and sell high when the think the market will go up or down.

I mean, what is the interest rate?Lol, I know, but it's not some master scheme to get rich. I'm just trying to decide if using some of that money now would be better in this one circumstance, in case the market does take a nose dive. It would be a one-time thing, trying to put some of that money to good use. Yes, it's sort of timing the market, but when I hear timing the market, I think of day traders trying to buy low and sell high when the think the market will go up or down.

It's around 4%... I'd probably make more interest keeping money in the market (unless we go into a recession), but I hate debt and like the idea of having that extra money every month. I max out my IRA every year, have been doing 10% into my ESPP and contribute to my 401K. It would feel better having a little more money each month for general savings, although I'm probably going to adjust my ESPP to 5% the next time around (this month).

Just do it if you want then.It's around 4%... I'd probably make more interest keeping money in the market (unless we go into a recession), but I hate debt and like the idea of having that extra money every month. I max out my IRA every year, have been doing 10% into my ESPP and contribute to my 401K. It would feel better having a little more money each month for general savings, although I'm probably going to adjust my ESPP to 5% the next time around (this month).

It's around 4%... I'd probably make more interest keeping money in the market (unless we go into a recession)

The only risk in paying off a debt is that inflation goes up, so it would be fairer to compare against long-term treasury bond yields, which have similar risks. The yield on a 30-year US bond is 2% right now, so the 4% return on paying off the debt is actually pretty attractive on a constant-risk basis.

Comparing debt against stocks really only makes sense if you are already 100% invested in stocks and you want to take on more risk.

This is why you don't try to time the market. Even though the market looked shaky and about to break down a mega pump might just happen.

Long term the market may still fade bit its hard to call a top and bottom. Market hasn't gone anywhere in two years anyway and usually you get a big rally before a fade. Just keep investing in a regular basis then you put money in when it is up and down.

Long term the market may still fade bit its hard to call a top and bottom. Market hasn't gone anywhere in two years anyway and usually you get a big rally before a fade. Just keep investing in a regular basis then you put money in when it is up and down.

Last edited:

Even though the expense ratio of VTSAX is a little higher than VTI. I think it might be better in the long run to not have any money sitting around and have it in the mutual fund. Thoughts? Also not entirely sure the best course of action; I need to sell everything of VTI and then buy VTSAX before the end of the trading day and it should all go through?

Vanguard's own graph shows a difference in return of $10 over 10 years, in VTI's favor. Personally I don't think it's worth bothering with unless you have a specific reason to do so. The biggest reason I have mutual funds is the option for automatic/bank draft investment.Even though the expense ratio of VTSAX is a little higher than VTI. I think it might be better in the long run to not have any money sitting around and have it in the mutual fund. Thoughts? Also not entirely sure the best course of action; I need to sell everything of VTI and then buy VTSAX before the end of the trading day and it should all go through?

You don't think which is worth bothering with unless you have a reason to do so?Vanguard's own graph shows a difference in return of $10 over 10 years, in VTI's favor. Personally I don't think it's worth bothering with unless you have a specific reason to do so. The biggest reason I have mutual funds is the option for automatic/bank draft investment.

Honestly the automatic investments does sound really nice and I'd like to have it. That is the second biggest reason I was considering mutual funds.

EDIT: Thanks for mentioning the Vanguard graph. I didn't realize Vanguard had a place right there where you could compare them so easily.

Changing from one to the other, I mean. The returns are effectively identical.You don't think which is worth bothering with unless you have a reason to do so?

Honestly the automatic investments does sound really nice and I'd like to have it. That is the second biggest reason I was considering mutual funds.

EDIT: Thanks for mentioning the Vanguard graph. I didn't realize Vanguard had a place right there where you could compare them so easily.

Oh okay, I understand now. ThanksChanging from one to the other, I mean. The returns are effectively identical.

I'm going to do massive funding of my ROTH IRA for the year at some point soon. I expect to have a bunch more cash within the next few weeks after we receive bonuses for the year.

Should I just fund my lazy portfolio immediately when it all comes in?

Or wait to see what happens with Brexit?

Blah blah blah I know timing the market, but we're talk about less than a month time span between the time period I'm looking at.

Should I just fund my lazy portfolio immediately when it all comes in?

Or wait to see what happens with Brexit?

Blah blah blah I know timing the market, but we're talk about less than a month time span between the time period I'm looking at.

Just fund it.I'm going to do massive funding of my ROTH IRA for the year at some point soon. I expect to have a bunch more cash within the next few weeks after we receive bonuses for the year.

Should I just fund my lazy portfolio immediately when it all comes in?

Or wait to see what happens with Brexit?

Blah blah blah I know timing the market, but we're talk about less than a month time span between the time period I'm looking at.

I don't think Brexit is enough of a surprise at this point to really shake up the market regardless of the outcome. No deal or remain would probably have a bigger impact than leaving with a deal, but I don't think any of them would substantially impact the global market this long after it the whole ordeal started.

I've done so today. Will keep funding each month until this maxes out for the year.

<3I've done so today. Will keep funding each month until this maxes out for the year.

Do you guys shuffle money to different HYSA as the rates change, stick with what you picked, or stay with something as long as it remains above a certain level?

Right now I have checking and savings with Capital One 360 and will possibly keep it as my primary but I've been thinking about opening an Ally account. I would open a checking and savings so I could save but also get a debit card attached to the checking account. On the sign up page they show both a checking and money market account and I can't tell why I would pick interest checking. Money market says it comes with debit card and checks as well as having better rates than interest checking.

EDIT: Actually both types of accounts get debit card so idk why the sign up page implies one thing but the FAQ says another

EDIT 2: Looks like money market is more of a hybrid and is subject to that 6 transaction limit per month. I'll do standard checking and savings

Right now I have checking and savings with Capital One 360 and will possibly keep it as my primary but I've been thinking about opening an Ally account. I would open a checking and savings so I could save but also get a debit card attached to the checking account. On the sign up page they show both a checking and money market account and I can't tell why I would pick interest checking. Money market says it comes with debit card and checks as well as having better rates than interest checking.

EDIT: Actually both types of accounts get debit card so idk why the sign up page implies one thing but the FAQ says another

EDIT 2: Looks like money market is more of a hybrid and is subject to that 6 transaction limit per month. I'll do standard checking and savings

Last edited:

Maxed out my TFSA and I'm probably going to end up selling ALL my current holdings in my TFSA and rebalancing by just buying everything in VEQT. (since I currently have a somewhat weird assortment of VUS, VEE etc. Might as well just consolidate and save the headache and re-balancing trouble.)

Mr. President, please tweet something very stupid while I'm re-balancing and not before or after, thank you.

Mr. President, please tweet something very stupid while I'm re-balancing and not before or after, thank you.

I have a decent amount of money invested in stocks/mutual funds that are not in tax-advantaged accounts (e.g., not in ROTH or traditional IRAs). I plan to hold this money for retirement in 30+ years. Is there any suggested plan of attack or advice to transition it into an IRA or some other tax-advantaged account, or is it more or less stuck where it's at and I'll just pay the taxes come retirement as I draw down on the money?

I'm kinda stoked, just passed six figures in my 401k and a quarter million invested overall. 🤘

I'm kinda stoked, just passed six figures in my 401k and a quarter million invested overall. 🤘

Boss! Hopefully that'll be me too one day

That's the good shit. We were $500 from having 300k in investments going into the weekend haha. It was taunting us.

I'm kinda stoked, just passed six figures in my 401k and a quarter million invested overall. 🤘

Grats! I set a goal of 6 figured overall by the time I was 30. I got away from the goal setting for a couple of years but not the investing. It's crazy how fast it starts building.

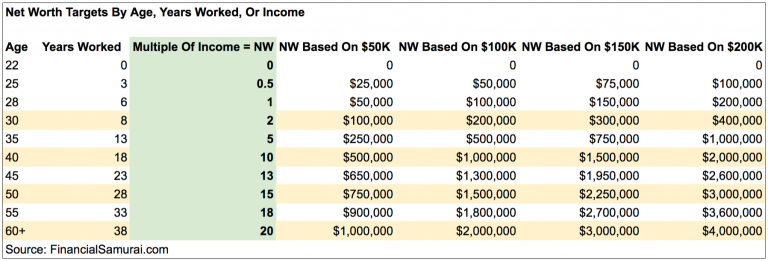

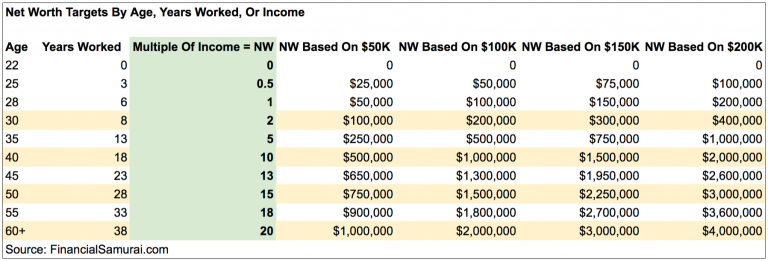

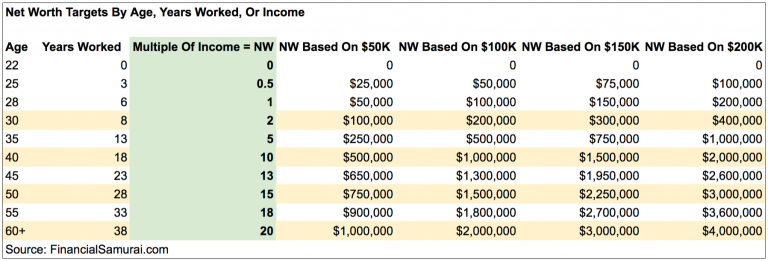

While the majority of the information from the source below is mostly meant for high/over achievers, I think this is a pretty good reference point overall for the masses (obviously, everyone's personal situation will be different). It's all about time and compound interest, short term investments are mostly only for people placing very large bets at once (day traders).Grats! I set a goal of 6 figured overall by the time I was 30. I got away from the goal setting for a couple of years but not the investing. It's crazy how fast it starts building.

While the majority of the information from the source below is mostly meant for high/over achievers, I think this is a pretty good reference point overall for the masses (obviously, everyone's personal situation will be different). It's all about time and compound interest, short term investments are mostly only for people placing very large bets at once (day traders).

I've never really understood these graphs. Looking at the making 50k a year ex. How are you supposed to double your investment from 50k to 100k from 28 to 30?

Is there any information or tactics I am missing?

You don't need to double your salary in 2yrs if that's what you are saying. By then, you would have had around 7yrs in the workforce, so if you had the usual retirement vehicles like 401k (ideally with Fidelity or Vanguard if not offered via employer, with selected investments being low fee and optimally balanced to your liking between large/mid/small/international/bonds), a Traditional or Roth IRA (currently $6k/yr for individuals, I personally throw it into an S&P500 mutual index fund), and maybe a HSA, this baseline will rise exponentially due to the factors I mentioned earlier.I've never really understood these graphs. Looking at the making 50k a year ex. How are you supposed to double your investment from 50k to 100k from 28 to 30?

Is there any information or tactics I am missing?

This is a reliable way to grow at an average of ~7% year over year over a long period of time if done correctly. And by nature, this strategy means you pretty much only need to do it once and maybe touch it once a year at most. Set it and forget it.

Probably several assumptions.I've never really understood these graphs. Looking at the making 50k a year ex. How are you supposed to double your investment from 50k to 100k from 28 to 30?

Is there any information or tactics I am missing?

Average market returns

Continued investment

Wage increase + investment increase

Not much of a hard rule since any of those or more could go wrong, but don't underestimate the power of compound interest.

You don't need to double your salary in 2yrs if that's what you are saying. By then, you would have had around 7yrs in the workforce, so if you had the usual retirement vehicles like 401k (ideally with Fidelity or Vanguard if not offered via employer, with selected investments being low fee and optimally balanced to your liking between large/mid/small/international/bonds), a Traditional or Roth IRA (currently $6k/yr for individuals, I personally throw it into an S&P500 mutual index fund), and maybe a HSA, this baseline will rise exponentially due to the factors I mentioned earlier.

This is a reliable way to grow at an average of ~7% year over year over a long period of time if done correctly. And by nature, this strategy means you pretty much only need to do it once and maybe touch it once a year at most. Set it and forget it.

Appreciate the detailed response. That wasn't what I was saying but you might have answered my question anyway. I make around that but do not have access to a 401k (company I work for doesn't offer).

So all my gains that aren't in my Roth IRA are being taxed yearly.

I on the other hand, just took out a big mortgage.. lol

Networth at least is somewhere up there though?

According to that chart, my "family" networth (it's just me and husband right now) is on track or ahead or the game in huge part thanks to the explosion of real estate value in Toronto.

Networth at least is somewhere up there though?

According to that chart, my "family" networth (it's just me and husband right now) is on track or ahead or the game in huge part thanks to the explosion of real estate value in Toronto.

If you average my husband's and my ages we're above the NW for our income group so yay?

Yeah, the increase in our house value increased our net worth by over $200k by doing absolutely nothing except buying near the bottom of the market.I on the other hand, just took out a big mortgage.. lol

Networth at least is somewhere up there though?

According to that chart, my "family" networth (it's just me and husband right now) is on track or ahead or the game in huge part thanks to the explosion of real estate value in Toronto.

While the majority of the information from the source below is mostly meant for high/over achievers, I think this is a pretty good reference point overall for the masses (obviously, everyone's personal situation will be different). It's all about time and compound interest, short term investments are mostly only for people placing very large bets at once (day traders).

So in 3 years of working at 50k I'm supposed to have been able to put away 25k in savings? I pay 1/3 of my monthly income on rent alone, good one...

So in 3 years of working at 50k I'm supposed to have been able to put away 25k in savings? I pay 1/3 of my monthly income on rent alone, good one...

6,000 to a Roth IRA in 3 years alone is 18,000 before you even factor in any growth

Time is on your side.Turning 30 next year but my years worked will only be 5. And foolishly only started a Roth IRA this year. I really got to get a handle on things

You don't want to play that game, my rent is >2/3 my monthly income. Factor in bonuses and things change enough so that I am ahead of the curve. The only winners here are the expensive ass land owners in SIlicon Valley.So in 3 years of working at 50k I'm supposed to have been able to put away 25k in savings? I pay 1/3 of my monthly income on rent alone, good one...

Thanks, you're right. I just get really anxious when I feel like I'm behind and knowing I didn't get off to as great of a start as I could have.