It's quite amazing how many people have never used Google.

-

Ever wanted an RSS feed of all your favorite gaming news sites? Go check out our new Gaming Headlines feed! Read more about it here.

-

We have made minor adjustments to how the search bar works on ResetEra. You can read about the changes here.

Nintendo stock falls 9.3% over lower Switch console sales target

- Thread starter SRO7

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I hope everyone that invests in the stock market for reasons of pure avarice lose all their money.

Sony and Nintendo are both down near double digits yet posted record sales and profits? I just don't get WallStreet investors.

They don't understand the market they're investing in.

They missed their sales targets on hardware both for Switch and 3DS, so of course. Are they doomed? Of course not, but it still isn't good.

Step 1: Denial

If you forecast too low and end up going over it, it looks just as bad because it makes your forecasting appear unreliable. Additionally, if you forecast low, it seems your expectation is low, and investors won't want to buy.I have to wonder what their strategy was when they set their forecast at 20 million. Even if they thought they would hit 20 million, what would have been the downside of being a little more conservative?

SNE on NYSE is down 9.18%.

The report was awesome. Massive profit growth. Software sales booming, digital share of software climbing. Even hardware is up 20% YOY worldwide without a price cut. 40% hardware growth in Europe which is their traditionally weaker market.

BUT, when you mix the words cutting and forecast in the same sentence, investors panic.

The stock is priced for flat profit in 2019 or even a profit decline. All doom and gloom right now. But the Switch business is booming and their prospects in mobile are insane in the mid and long term.

BUT, when you mix the words cutting and forecast in the same sentence, investors panic.

The stock is priced for flat profit in 2019 or even a profit decline. All doom and gloom right now. But the Switch business is booming and their prospects in mobile are insane in the mid and long term.

It's quite amazing how rude you are.

If you forecast too low and end up going over it, it looks just as bad because it makes your forecasting appear unreliable. Additionally, if you forecast low, it seems your expectation is low, and investors won't want to buy.

I get that, but would 17 or 18 million have been considered low? Or if they had shipped 20 million despite forecasting 17, would that really have been a worse look than the opposite? Besides, nothing prevented them from forecasting 17 million at first then upping their forecast later on if they saw more signs that they were gonna reach 20. It just seems like they set a target they knew was very high instead of just setting a high but realistic target. Maybe they were really that confident in Labo expanding the Switch's reach and severely underestimated every other game, because they're smashing their software forecast despite Labo landing with a thud.

But then investors move on to other stocks promising higher return, and if you have a history of projecting conservative numbers that beat, it gets baked in anyway.

You're totally right. Whatever you do, you doing it wrong anyways ;)But then investors move on to other stocks promising higher return, and if you have a history of projecting conservative numbers that beat, it gets baked in anyway.

Nintendo will be fine; can you post when the stock prices goes up? Then can post again when it goes down? Makes for nonsense conversation.

What does a company have to do to make their investors happy? consistently breaking records isn't enough?

Doesn't this just mean its a great time to invest in some nintendo stocks?

Even knowing nothing about the stock market, isn't there absolutely little to no chance you wouldn't make your money back in strides?

animal crossing, pokemon gen 8, detective pikachu film, universal theme park opening in 2020...

Doesn't this just mean its a great time to invest in some nintendo stocks?

Even knowing nothing about the stock market, isn't there absolutely little to no chance you wouldn't make your money back in strides?

animal crossing, pokemon gen 8, detective pikachu film, universal theme park opening in 2020...

I don't know. I'm not a finance guy. I'm really just parroting what a colleague in MTX told me when I asked him why he doesn't just low-ball his forecasts.I get that, but would 17 or 18 million have been considered low? Or if they had shipped 20 million despite forecasting 17, would that really have been a worse look than the opposite? Besides, nothing prevented them from forecasting 17 million at first then upping their forecast later on if they saw more signs that they were gonna reach 20. It just seems like they set a target they knew was very high instead of just setting a high but realistic target. Maybe they were really that confident in Labo expanding the Switch's reach and severely underestimated every other game, because they're smashing their software forecast despite Labo landing with a thud.

Normal market reaction.

Stock holders don't always have a great deal of knowledge about a sector. They see a black and white target and that target hasnt been met. They dont always see the colour around that where Switch sales are actually still amazing regardless of that goal.

Yeah, and it's not even the stock holders who are the ones deciding to sell, it's the people who manage stockholder's investment portfolios, which are spread across multiple sectors. The vast majority of investors just don't give a shit about Nintendo, or know anything about them, that's just how the system works. There will be thousands of investors who probably aren't even aware that they own Nintendo stock, because the only part of their portfolio that interests them is making profit.

Wow, they crushed their revenue for the year, and it still went down. Talk about ridiculous

Keep in mind Sony's stock went down too but no one is making a thread about that.

The Mario kart tour delay could be another explanation. Never forget that for investors, mobile = $$$.

Time to buy approaching fast, stock nosediving all year long because nobody expected them to hit 20M, and when admitted they won't, shocked investors sell even more.

I do think the stock is undervalued as it's selling better than PS4 at the same timeframe (and the huge software revenue) so it'll bounce back pretty fast.

Kimishima with that goodbye gift to Furukawa by putting that 20M forecast was really a devil move.

I do think the stock is undervalued as it's selling better than PS4 at the same timeframe (and the huge software revenue) so it'll bounce back pretty fast.

Kimishima with that goodbye gift to Furukawa by putting that 20M forecast was really a devil move.

The (anti-)fan fiction from our favourite Bloomberg reporter has come up with a doozy of a headline this time: Nintendo Switch Starts to Sputter Less Than Two Years From Debut

Clickbait Title:Didn't Click;

It was so bad that...

NINTENDOOOMED

If there is one thing I can't understand about Yuji is his fixation in "Nintendo needs to expand beyond its loyal fan-base". In pretty much all markets as well as WW LTD the Switch is right there among the most sucessful consoles ofnall time regarding unit sales (PS4, PS2, Wii).

Seriously, it makes zero sense.

Why are some saying Sony shares are down? I'm seeing them as slightly up 0.59%, whilst Nintendo's are down 9.19%.

https://www.google.com/search?q=SNE+on+NYSE&rlz=1C1CHBF_enUS780US780&oq=SNE+on+NYSE

It's now up slightly, but was at -9.09% earlier.

Basically with both Nintendo and Sony dropping makes sort of a non-story.

What does a company have to do to make their investors happy? consistently breaking records isn't enough?

Doesn't this just mean its a great time to invest in some nintendo stocks?

Even knowing nothing about the stock market, isn't there absolutely little to no chance you wouldn't make your money back in strides?

animal crossing, pokemon gen 8, detective pikachu film, universal theme park opening in 2020...

Stock prices are heavily speculative. There's something called a Forward P/E ratio that basically says how much a stock is priced above it's actual earning capabilities. Companies like Tesla, Amazon, etc all trade a very high Forward P/E because investors believe they will continue to grow. Something like GE trades at a lower P/E because they aren't in a growth stage.

Nintendo is a bit of an odd-ball, they have been around a long time so they aren't really in a growth stage but they have such good IP that they could experience explosive growth at any moment like what happened with the Wii and the Switch. So Nintendo's P/E is around 30 which is way less than Amazon at 100 but more than someone like Nvidia at 20. So the stock price will move based not on how well they do in past quarters but how well they project they will do in the future.

The stock drop is about the lowered guidance, not the earnings. If you lower your guidance you are basically telling investors that you expect to grow less/make less in the following quarter.

Traders are simply backing off of their bet that Nintendo is in a growth stage as the explosiveness of the Switch is slowing down. The P/E is still large enough to account for amusement parks, mobile, etc. That's the only reason they are actually priced higher than their Wii U days. If they swing and miss on mobile or capitalizing on their IP through non-video game means the price will continue to drop in the foreseeable future.

I sold out of Nintendo about 6 months ago.

Sony and Nintendo are both down near double digits yet posted record sales and profits? I just don't get WallStreet investors.

Its all about growth. You can have record profits and the stock price drops if you don't show sufficient enough growth. For Nintendo (I haven't gone into the Sony numbers) the hardware numbers are relatively flat despite the raw numbers looking pretty good. On the software side things are looking great but also if there are concerns about hardware growth then there will be concerns about software growth down the line as well despite how good things are right now. The raw numbers are great and Nintendo is in no danger of being in any sort of real trouble for a long time but I can see where some investors might be a little skittish on the growth front.

Stock prices are heavily speculative. There's something called a Forward P/E ratio that basically says how much a stock is priced above it's actual earning capabilities. Companies like Tesla, Amazon, etc all trade a very high Forward P/E because investors believe they will continue to grow. Something like GE trades at a lower P/E because they aren't in a growth stage.

Nintendo is a bit of an odd-ball, they have been around a long time so they aren't really in a growth stage but they have such good IP that they could experience explosive growth at any moment like what happened with the Wii and the Switch. So Nintendo's P/E is around 30 which is way less than Amazon at 100 but more than someone like Nvidia at 20. So the stock price will move based not on how well they do in past quarters but how well they project they will do in the future.

Traders are simply backing off of their bet that Nintendo is in a growth stage as the explosiveness of the Switch is slowing down. The P/E is still large enough to account for amusement parks, mobile, etc. That's the only reason they are actually priced higher than their Wii U days. If they swing and miss on mobile or capitalizing on their IP through non-video game means the price will continue to drop in the foreseeable future.

I sold out of Nintendo about 6 months ago.

Thanks for the info, ive always thought there has to be some kind of mechanism that they use to try to safely predict future growth/loss.

Seeing as you sold, you dont think the theme park would make that big of a splash?

The Stock Market is just a tool of investment. Sadly there are tons of shitty people and speculators gaming the stock market's ruleset. It's not good or evil. It isn't your friend or enemy it is just a utility. The people who abuse the system and prey on the vulnerable and a government who allows it are the actual villains and that is why we need more oversight. It is always kind of vexing when people comment on a system they sound like they've never even waded into just because one of their favorite company's took a dip.

Tbf that's how it should be. No one wants to buy something that will nosedive in value the next day.

The problem is that Nintendo's is very volatile since a good chunk of their shareholders want them to focus almost exclusively on mobile, so no matter how well their console business is doing it's never enough for that particular group. Their stock value is too dependent on imaginary potential rather than what they excel at.

I mean, the way things are today, there is nothing from stopping anyone that wants to enter to the market to do so at zero cost and with the ability to buy fractional shares in some of these free apps, the notion that it's only for people with a lot of money is laughable.

6% of $1,000,000 is obviously way more than 6% of $100, but 6%(especially if there is any sort of compounding) of $100 is a hell of a lot more than 0% of $100.

You have people that make edgy post that sound cool with no intelligence behind them...and then you have these posts. Millions of people buy and sell stocks every day, each with their own reasonings for doing so.

Certain shareholders had certain value in the hardware sales and new mobile software, and decided to remove the money from Nintendo to spend it on other stocks. That is all...no one is dumb or evil lol.

So did Microsoft

Stock prices are heavily speculative. There's something called a Forward P/E ratio that basically says how much a stock is priced above it's actual earning capabilities. Companies like Tesla, Amazon, etc all trade a very high Forward P/E because investors believe they will continue to grow. Something like GE trades at a lower P/E because they aren't in a growth stage.

Nintendo is a bit of an odd-ball, they have been around a long time so they aren't really in a growth stage but they have such good IP that they could experience explosive growth at any moment like what happened with the Wii and the Switch. So Nintendo's P/E is around 30 which is way less than Amazon at 100 but more than someone like Nvidia at 20. So the stock price will move based not on how well they do in past quarters but how well they project they will do in the future.

The stock drop is about the lowered guidance, not the earnings. If you lower your guidance you are basically telling investors that you expect to grow less/make less in the following quarter.

Traders are simply backing off of their bet that Nintendo is in a growth stage as the explosiveness of the Switch is slowing down. The P/E is still large enough to account for amusement parks, mobile, etc. That's the only reason they are actually priced higher than their Wii U days. If they swing and miss on mobile or capitalizing on their IP through non-video game means the price will continue to drop in the foreseeable future.

I sold out of Nintendo about 6 months ago.

Thank you for the detailed post. How relevant are Nintendo dividends for long-term investors?

I think the reaction in this case was more towards the briefing that took place the next day. Whilst Nintendo did revise its hardware forecast down, investors right now are more concerned where the next 20m will come from and whether Nintendo will be able to execute the strategy it outlined yesterday.

That being said, the price will probably bounce back up again once there is a clearer picture of next fiscal year.

That being said, the price will probably bounce back up again once there is a clearer picture of next fiscal year.

You have people that make edgy post that sound cool with no intelligence behind them...and then you have these posts. Millions of people buy and sell stocks every day, each with their own reasonings for doing so.

Certain shareholders had certain value in the hardware sales and new mobile software, and decided to remove the money from Nintendo to spend it on other stocks. That is all...no one is dumb or evil lol.

Agreed. The dumbness or evilness is just people's projections. The Stock Market is amoral. It is just a system like any other. That is not to say there aren't cancerous operants working within. But that is the same with any system. Politics, Entertainment, Religion, sunday nights of elder folk Bingo. People are just silly.

Keep in mind Sony's stock went down too but no one is making a thread about that.

How reliant is SNE on its videogames business vis a vis Nintendo?

I think the reaction in this case was more towards the briefing that took place the next day. Whilst Nintendo did revise its hardware forecast down, investors right now are more concerned where the next 20m will come from and whether Nintendo will be able to execute the strategy it outlined yesterday.

That being said, the price will probably bounce back up again once there is a clearer picture of next fiscal year.

This was my take too. The hardware target was at least partially baked into the price but it was really the results briefing the next day which didn't address anything regarding future momentum that probably spooked some investors.

They're being a bit too tight lipped for their own good at the moment. I'll never understand why they feel the need for such secrecy all the time.

Thanks for the info, ive always thought there has to be some kind of mechanism that they use to try to safely predict future growth/loss.

Seeing as you sold, you dont think the theme park would make that big of a splash?

I don't think it'll move the needle in terms of their profits. It's more about brand recognition and advertising to a larger audience. How many kids are going to go on a Mario themed ride and then go home and ask their parents if they can buy Mario? That's the goal of exposing your IP through other means such as amusement parks.

It'll be interesting to see how the Pikachu detective movie will do but remember that Nintendo only owns 33% of that and the profit they'll see from the movie won't move the needle as the profit from Pokemon GO didn't really either. If the movie sells gangbusters a lot of investors will by Nintendo incorrectly and then sell (which happened with Pokemon GO, they actually had to release a statement to investors saying it wasn't their game) but the renewed brand recognition will keep the price higher.

What I would bet on is if Mario Kart World Tour becomes an overnight phenomenon and makes them a lot of money in the mobile market. So far they do well with FE Heroes and Dragalia Lost but those haven't reached social media levels of hysteria that generate explosive growth like Fortnite. Mario Kart could do that.

You could certainly invest long term but that is a risk because if their next console is a flop we'll see Wii U level prices which is about 66% down from what is is right now. To me Nintendo is risky because right now everything rides on their console success to drive profit and until they can find more than one leg to stand on (mobile or other IP licensing) a failure can be real bad for their stock price (this isn't Nintendo is doomed, they have hoards of cash to fall back on and could fail multiple consoles in a row).

I'm just staying away as a long term play, it seems on the downtrend and a short term gain would rely on a flash in the pan success for that I just don't see coming.

This is the long-term chart, right now looks eerily similar to the Wii days to me. The time to buy has passed?

That all being said I'm far from qualified to be giving advice, it's just my opinion.

Thank you for the detailed post. How relevant are Nintendo dividends for long-term investors?

Very little, less than a percent. You'd make more in a Capital One 360 account. I think there is something funky with the US investors too, they only get a portion of the dividend Japanese investors get. Been a while since I was involved with it so I forget.

I mean sure, but with Animal Crossing and Gen 8 Pokémon already announced I don't see how they are left wondering where the next 20m will come from lolI think the reaction in this case was more towards the briefing that took place the next day. Whilst Nintendo did revise its hardware forecast down, investors right now are more concerned where the next 20m will come from and whether Nintendo will be able to execute the strategy it outlined yesterday.

That being said, the price will probably bounce back up again once there is a clearer picture of next fiscal year.

A lot of Nintendo's shareholders have been demanding a mobile focus for close to a decade now. Before they announced mobile plans in 2015, they used to get requests to go mobile at every single investors meeting.You have people that make edgy post that sound cool with no intelligence behind them...and then you have these posts. Millions of people buy and sell stocks every day, each with their own reasonings for doing so.

Certain shareholders had certain value in the hardware sales and new mobile software, and decided to remove the money from Nintendo to spend it on other stocks. That is all...no one is dumb or evil lol.

This is reinforced by market analysts, many of which downplay Nintendo's console successes at every turn and keep telling their investors that mobile = good, not mobile = not good. If you want proof just look at the stock price history; mobile news make it swing more than anything else, while non-mobile news barely move the needle unless it's bad news. The stock drop from today is almost assuredly due to a combination of the hardware forecast being slashed and Mario Kart Tour being delayed.

I don't know. I'm not a finance guy. I'm really just parroting what a colleague in MTX told me when I asked him why he doesn't just low-ball his forecasts.

You are correct, however one also has to factor in that investors are irrational.

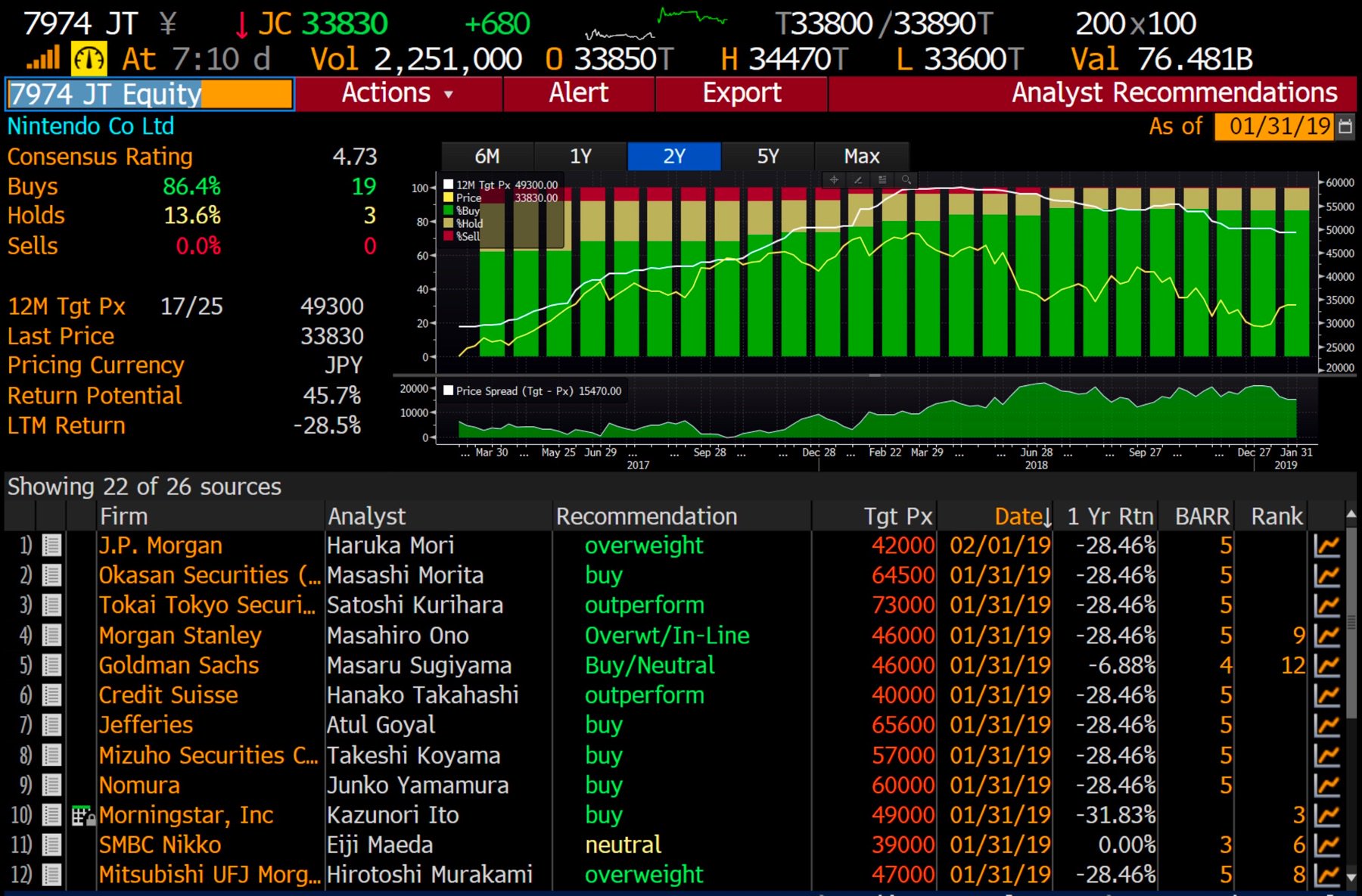

Exhibit A: