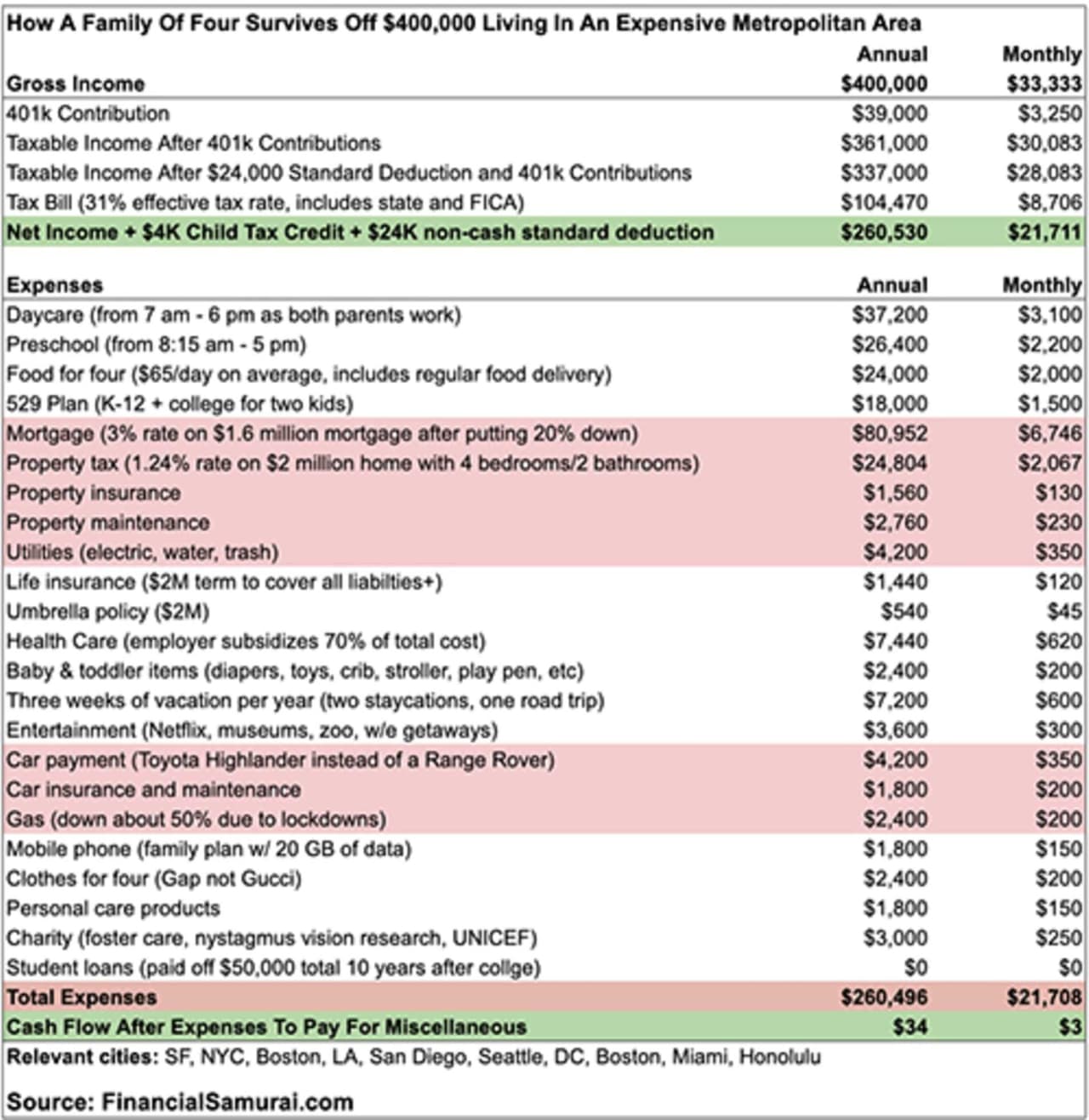

And it'd be a different case for a doctor who had six figure student loan debt as well. I just wish these websites/graphics were honest about how much wealth the average 400k income earner actually has. Because they never are.

Yeah, this article is hilarious. Like, if these people have kids that young, their student loans weren't just 50k.

I know plenty of docs who get out of residency, and are like, "okay, time to pay off the 300k in student loans now, I guess?"

Most of them still driving their Camry.