Here's how much Americans have saved in their 401(k)s at every age

Only 1.6 million people withdrew money from their 401(k) under the CARES Act since March, according to data from Fidelity.

For many Americans, 2020 was a tough year financially. Between March 2020 and January 2021, around 1.6 million individuals took out savings from their 401(k) plans under the CARES Act, which allowed those affected by the pandemic to withdraw up to $100,000 without incurring the usual early withdrawal penalty, according to retirement-plan provider Fidelity. That represents 6.3% of eligible individuals using Fidelity's workplace savings platform.

But despite the volume of withdrawals from 401(k) accounts under the CARES Act, a third of 401(k) savers increased their savings rate in 2020. Fidelity also saw record contributions from women in the fourth quarter of 2020.

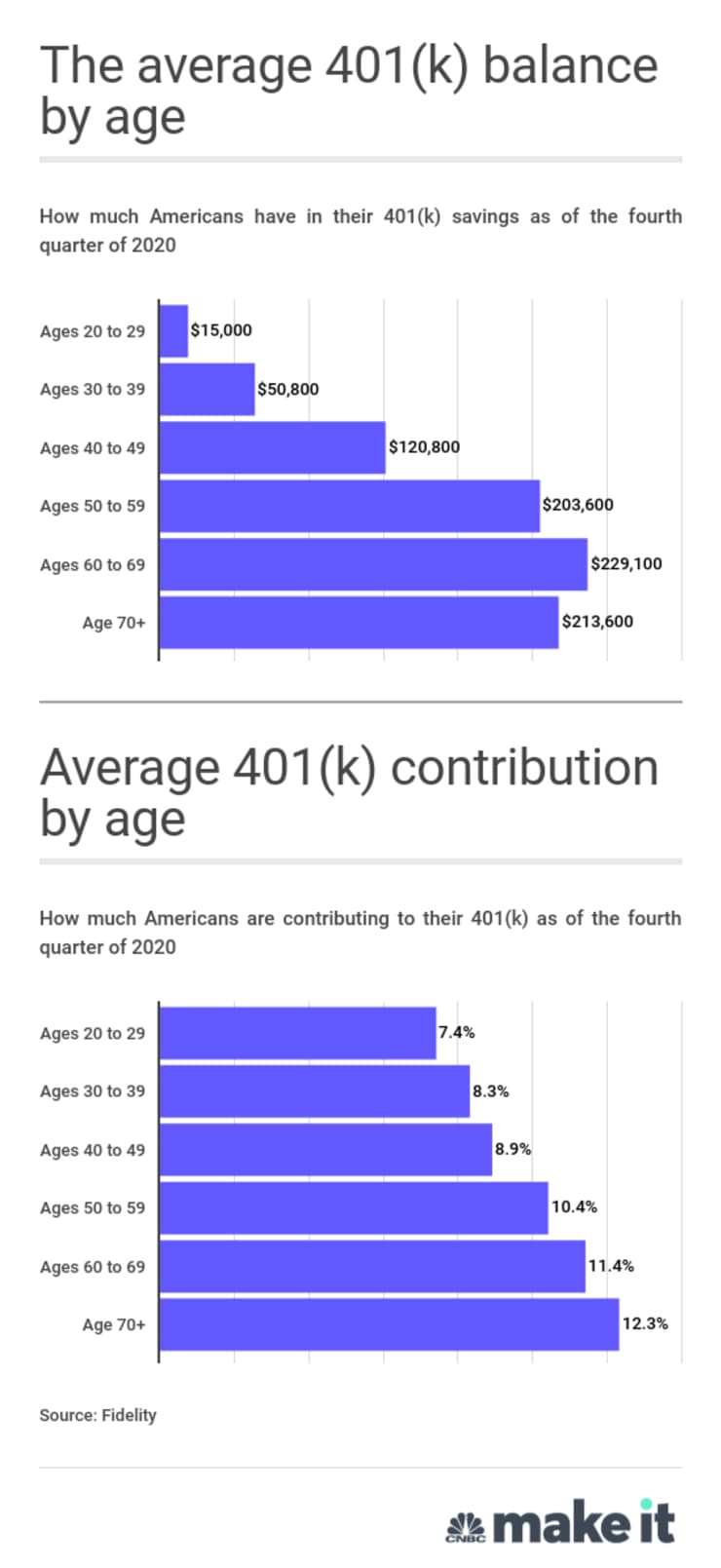

The overall average 401(k) balance came to $121,500 as of the fourth quarter of 2020, according to Fidelity.

"The most important thing is to start saving as early as possible and consistently over time because that is really what ends up building up your balance at retirement," says Eliza Badeau, vice president of thought leadership at Fidelity.

Although retirement may seem far away, it's better to start saving early because it allows you to ride out the highs and lows of the market, says Badeau.

Fidelity recommends having 10 times your salary socked away by the time you retire. To get there, the company recommends aiming to consistently save 15% of your income, including both your employee contribution and the employer match.

In addition to saving for retirement, it's also important to get your finances stable from a short-term perspective so you do not have to dip back into money that you have put away for the long-term, Badeau says.

Aim to save three to six months worth of living expenses in a liquid cash account. You should think of that as an emergency fund to keep you afloat if you were to lose your job, Badeau says.

It may seem overwhelming to try and save so much at one time, but it's OK to start small. Set achievable goals by saving one month at a time, and eventually work your way up to your desired balance.