Oh how stressful that must be. ☹

www.cnbc.com

www.cnbc.com

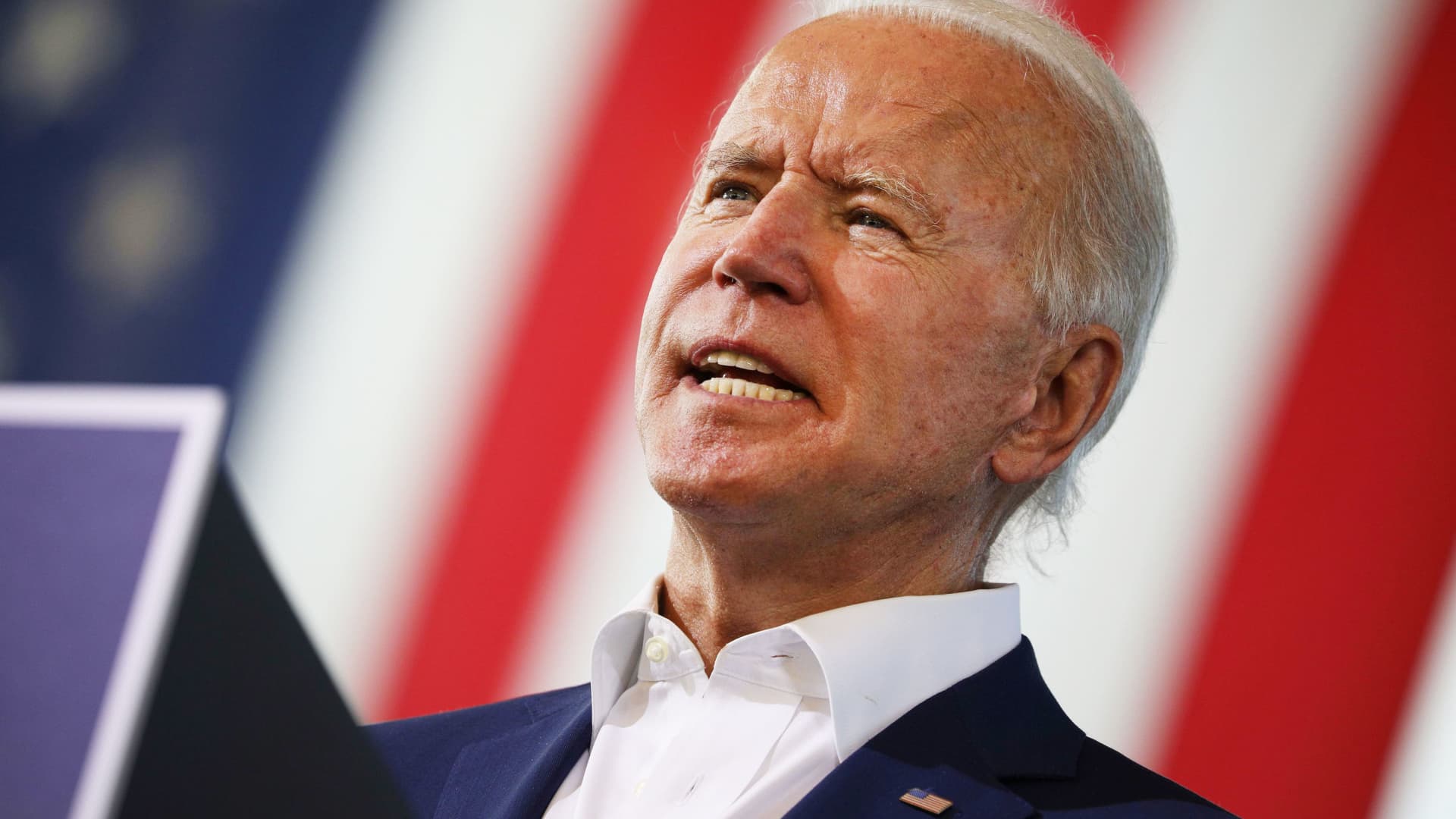

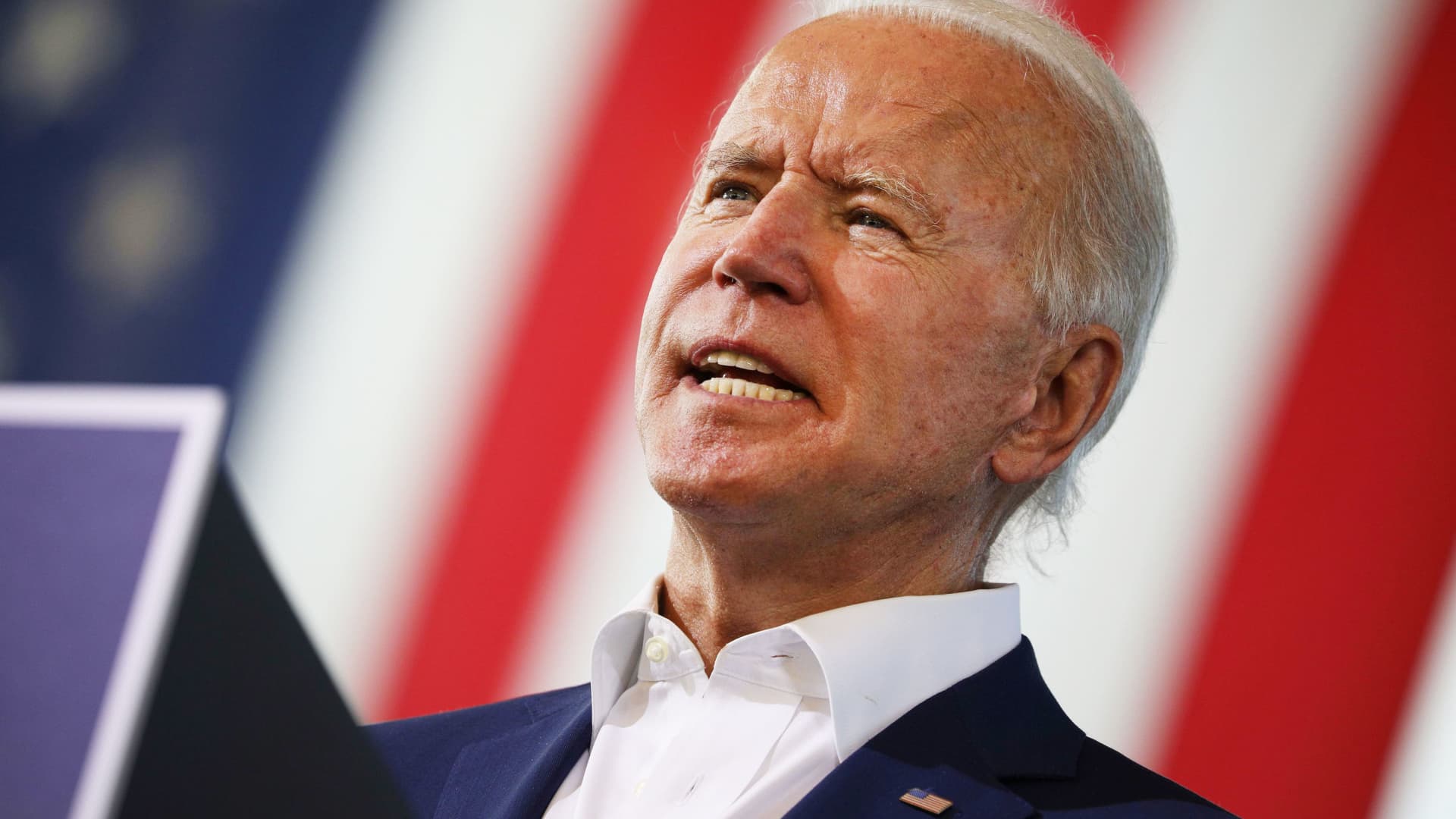

Here's why rich kids could get hundreds of billions from their parents if Biden wins

"Everything is being fast-tacked because of the election," said Suzanne Thau, trusts and estates attorney with Schwartz Sladkus Reich Greenberg Atlas. "It's just an explosion in estate planning activity."

The savings could be substantial. Under the 2017 tax cuts, wealthy parents can leave up to $11.58 million each, or $23.2 million per couple, during their lifetime without paying an estate or gift tax. Biden would cut that limit to $7 million and increase the current estate tax rate from 40% to 45%. Biden is also getting rid of what's known as step-up basis, which currently allows families to avoid paying capital gains on appreciated assets that are passed down or given at death.

A couple leaving $20 million to their kids would currently pay no estate tax, since up to $23.2 million is exempt. If Biden gets his tax plan, the same couple would pay $5.9 million in taxes on a $20 million gift.