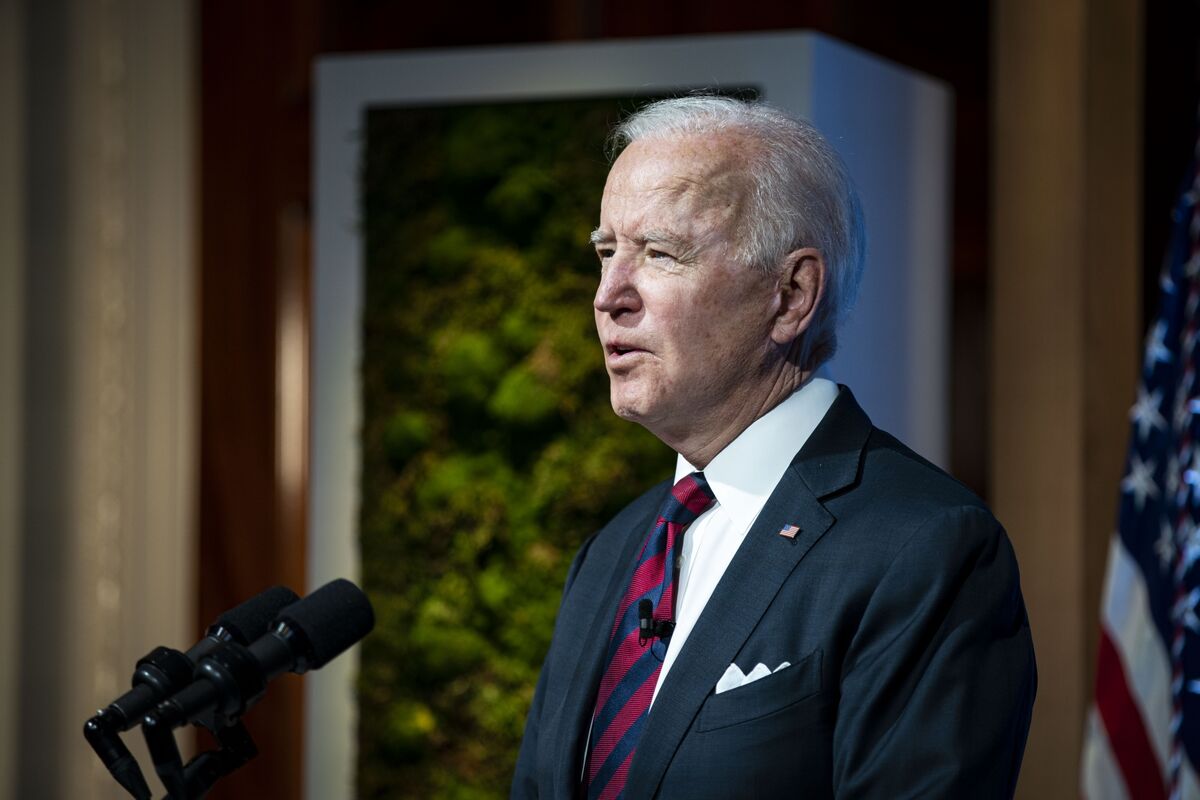

U.S stocks fell to session lows in a swift fashion on Thursday after a report that President Joe Biden is slated to propose capital gains taxes for the rich.

The S&P 500erased earlier gains and fell 0.5%. The Dow Jones Industrial Average dipped 230 points to its low of the day, while the Nasdaq Composite traded 0.3% lower.

Bloomberg News reported Thursday afternoon that Biden is planning a capital gains tax hike to as high as 43.4%. The proposed increase would nearly double the current rate for wealthy Americans.

Assuming this NYT piece is right:

To offset that cost, Mr. Biden will propose several tax increases he included in his campaign's "Build Back Better" agenda. That starts with raising the top marginal income tax rate to 39.6 percent from 37 percent, the level it was cut to by President Donald J. Trump's tax overhaul in 2017. Mr. Biden would also raise taxes on capital gains — the proceeds of selling an asset like a stock or a boat — for people earning more than $1 million, effectively increasing the rate they pay on that income to 39.6 percent from 20 percent.

Last edited: